Quarterly Investment Review and Outlook – March 31, 2024

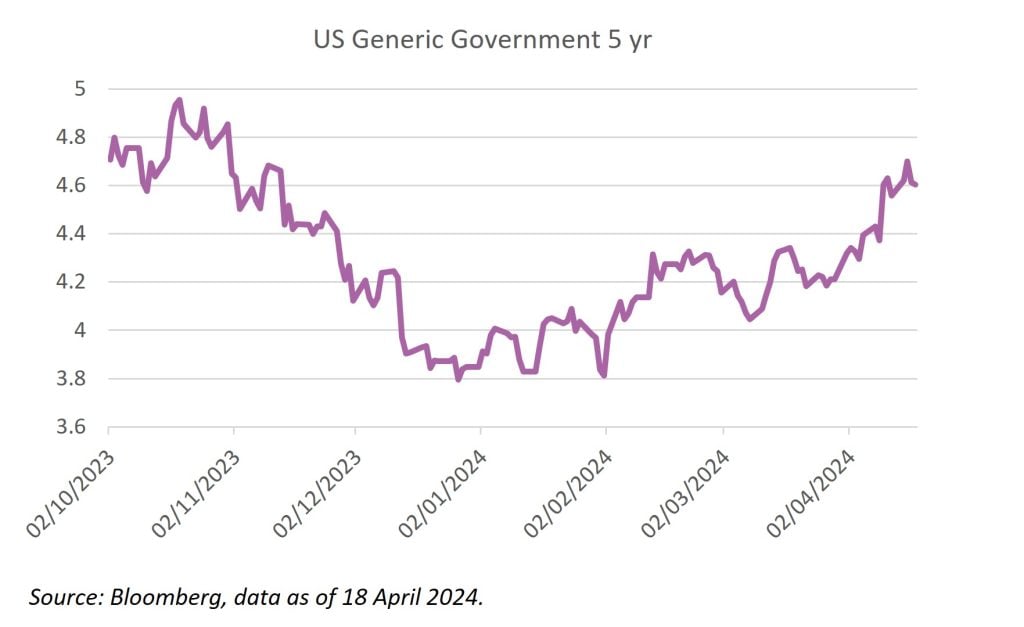

The shift in US monetary policy was short-lived. US 5-year yields dropped during the fourth quarter of 2023 (from 5% to 3.8%) with equity markets rallying significantly in response. As we close the first quarter of 2024, 5-year yields have climbed back to 4.6% (see chart below) yet the stock market remains undeterred. During the first quarter, the S&P, Eurostoxx, and Nikkei rose 10%, 10%, and 12% respectively (USD Price return).

What’s driving the rally?

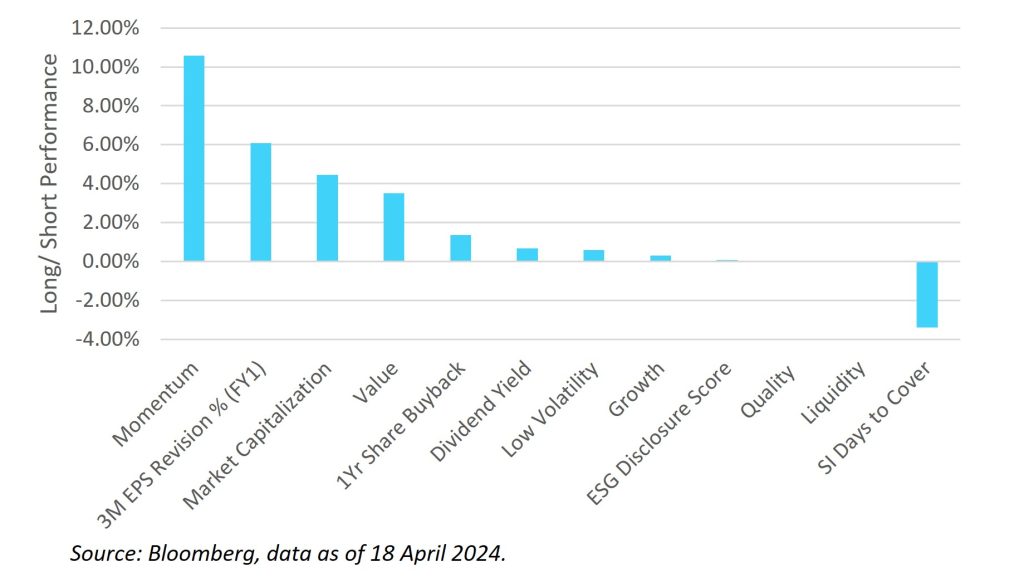

On a sector-relative basis, the biggest driver of this equity return was the momentum factor; a notable reversal from its poor performance during 2023. This was the standout factor albeit followed by EPS revisions, size, and value (when comparing the top quintile of each factor relative to the bottom quintile). See chart below.

Unsurprisingly the IT and communication services sectors were amongst the strongest performers during the first quarter, but there was an equally strong performance from the energy, industrials, and financials sectors. Rate-sensitive utilities and consumer staples lagged the market, as did the materials sector.

Are Soaring Stock Prices Justified?

To begin to answer this question, we need to consider other market factors.

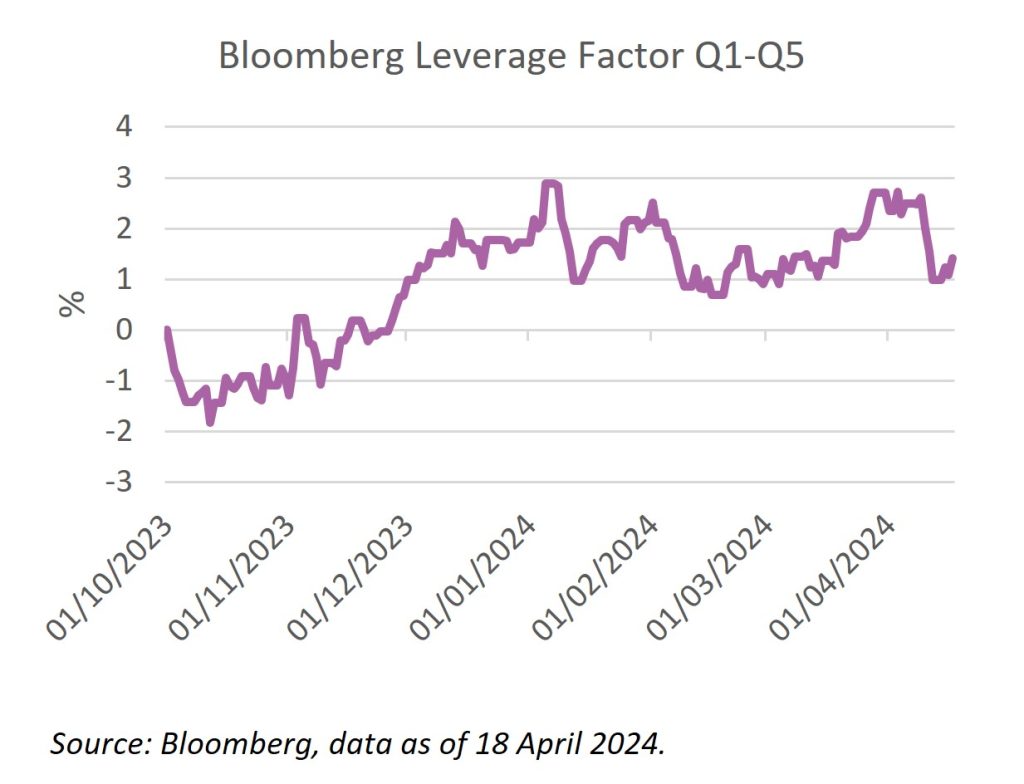

During the interest rate falls in late 2023, over-levered companies performed well. Interestingly, this trend has not reversed in line with the yield increase seen during the first quarter, and over-levered companies remained flat through the quarter.

Such exuberance in the equity markets feels excessive. Debt levels are at record highs – only to be matched by the record levels of the equity markets.

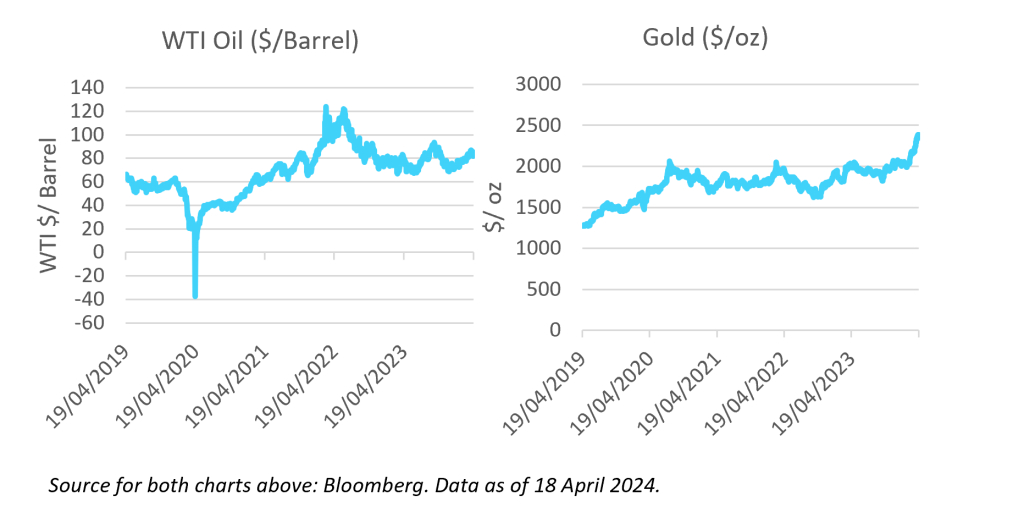

The crisis in the Middle East is putting further pressure on the price of oil which has broken through the $80/barrel mark once again. The price of gold also pushed past the $2,200 mark over the quarter; a clear indicator that the market does not believe inflation is under control. The question going forward is whether as we approach earnings season, equities can pass on such cost pressures and prove themselves a good inflation hedge. This may be possible if such inflation is based on demand. But, if it remains a supply-side constraint, then tough times will inevitably come for the stock markets, much like the rest of the economy.

What does all this mean for the sustainable transition?

As we witness the pressures growing on the global economy, the political resolve for the sustainability transition will be tested. Rising raw material costs create a great opportunity for alternative energy sources. Still, the greater cost of capital will inevitably add pressure on the required investment for the net zero transition.

Proving out the economic case for such a transition will be key. As the costs of energy and water increase and the opportunity cost of wasted raw materials becomes even more pertinent to the income statement, identifying those that are using these three key resources most efficiently continues to be both a financial and an environmentally prudent approach.

The investments set forth above should not be considered a recommendation to buy or sell any specific securities.