NB: The Osmosis Resource Efficient Core Equity (ex-Fossil Fuels) Fund, Class A is not available for US and Australian Investors. Separate accounts are available for US and Australian investors using the same model and investment objective of the Fund.

Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved. Data as of 29 February 2024. Osmosis Resource Efficient Core Equity (ex-Fossil Fuels) strategy is a systematic investment strategy. Returns represent the actual returns for the Core Equity (ex-Fossil Fuels) Fund, Class A. Such returns are net of fees, costs and dividend withholding tax. A client’s returns will be reduced by the advisory fee and other expenses incurred in the management of its account. The MSCI World Index captures large and midcap representation across 23 Developed Markets countries. With 1,645 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI World ex-Fossil Fuels Index has been selected for illustrative purposes only and is used as a comparison due to its fossil fuel exclusion. The MSCI World ex Fossil Fuels Index is based on the MSCI World Index, its parent index, and includes large and mid-cap stocks across 23 Developed Markets (DM) countries. The index represents the performance of the broad market while excluding companies that own oil, gas and coal reserves. Please see the performance calculation disclosure language here. Past performance is not an indication of future performance. *Osmosis received top ratings in the Principles of Responsible Investing (PRI) 2023 Assessment Report given on 22 December 2023 and corresponds to the annual reporting period of 1/1/2022 to 31/12/2022. This assessment is free for all PRI signatory members, however, all signatories are required to pay an annual membership fee (see disclosure language here). The Environmental Finance and ESG Investing Awards are free to applicants and are open to all organisations globally. The awards relate to the annual periods May 22 to May 23 and January 24 to December 24 respectively and were awarded on June 23 and March 24. Both organisations independently provided Osmosis with a questionnaire to be used in the preparation of the third-party rating or award.

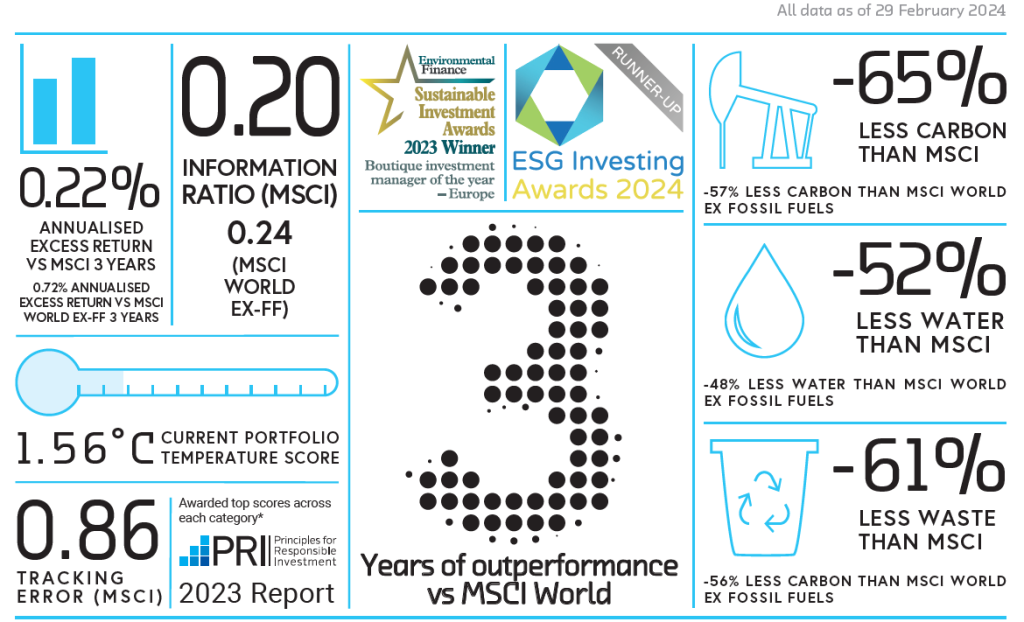

Ex-Fossil Fuels Strategy Defies Oil Price Rise, outperforming its benchmark since launch

Osmosis launched the Resource Efficient Core (Ex-Fossil Fuels) Strategy with a $250 million seed in February 2021. The Strategy was developed to offer investors a risk-controlled core portfolio that prohibits investment in companies that generate more than 5% of their revenues from fossil fuels or nuclear power generation, companies with any revenues from nuclear and controversial weapons and civilian firearms, tobacco companies, and companies in breach of any of the UN Global Compact Principles. Uniquely, the strategy addresses both the supply side of fossil fuel energy generation through divestment, and the demand side through the over and underweighting of companies based on their Resource Efficiency (carbon-produced, water consumed, and waste generated). Osmosis’ research has evidenced that its proprietary Resource Efficiency Factor, derived from an objectively driven in-house research program measuring the world’s leading corporations’ environmental efficiency, identifies high-quality companies with strong management teams generating a competitive advantage.

“The ability to weather asset price reflation in the energy sector as a result of rising oil prices was one of our primary goals in building the ex-fossil fuel strategy. Divestment decisions must be considered in the context of ‘fiduciary duty’ and should not be made at any cost nor undertaken without an awareness of active risk. Our models showed that the additional return derived from targeting resource-efficient companies across the broader portfolio would help offset any such asset price inflation. Launching the Strategy into an oil and commodity-based rally, we have been delighted to see the thesis hold true. “ (See page 2 in the pdf below). – Ben Dear, CEO