A Critique of Paris Aligned Benchmarks

By Dr. Tom Steffen, Head of Quant Research, Osmosis Investment Management

For institutional investors with decarbonisation targets, tracking an index that follows the EU’s Paris Aligned Benchmark (PAB) rules can provide a practical solution. It relieves investors of some of the burdens of interpreting and implementing the Paris-aligned guidelines themselves and requires no extra monitoring of portfolio managers. But are they the best way of reaching a 1.5°C outcome? In this piece, we argue that they are not. In fact, far from facilitating the pathway to Paris, PABs could actually be acting as an obstacle to an all-economy transition.

Speed Read

- Paris Aligned Benchmarks (PABs) offer a solution to align investments with a 1.5°C world. However, PABs should not be seen as the only solution to reaching the temperature target.

- The PAB rulebook imposes rigid requirements on the emission trajectory of an index even though what matters most are the portfolio’s cumulative emissions over time.

- Index providers resorted to reallocating capital to low-impact sectors to achieve the prescribed rate of decarbonisation. Companies in high-impact sectors are not incentivised to transition to greener operations.

- Design flaws of PABs lead to a decoupling of the benchmarks from the real economy, preventing true progress to a 1.5°C world as well as risking to leave investors worse off.

- Achieving all-economy Paris Alignment in portfolios is possible but requires a more nuanced approach to avoid unintended consequences.

Background

Paris Aligned Benchmark Is Not Synonymous to Paris Agreement

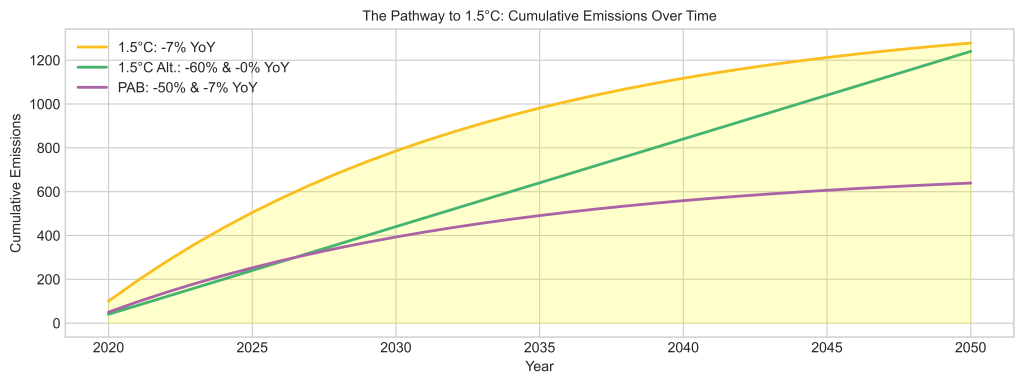

Paris Alignment is the goal to achieve 1.5°C with no or limited overshoot. Based on climate science, the Intergovernmental Panel for Climate Change (IPCC) estimates that global emissions will need to decrease by 7.6% annually starting from 2020.[i] The EU Technical Expert Group (TEG) on Sustainable Finance derived a similar annual decarbonisation rate of 7%. Figure 1 shows the corresponding emission trajectory using 2020 as the base year.

The EU TEG developed the Paris Aligned Benchmark (PAB) rulebook stipulating standards for an index to align with the Paris temperature goal of 1.5°C. The minimum requirements are: 1) a 7% year-on-year average self-decarbonisation in line with IPCC’s 1.5°C scenario; 2) an initial carbon intensity reduction of 50% relative to the investable universe. Figure 2 shows the respective PAB trajectory in purple.

As the purple line shows, the PAB rulebook will achieve Paris Alignment, but the deviation from the yellow line, driven by the minimum requirements set in stone by the TEG, raises the question if the PAB trajectory allows for enough flexibility to tackle climate change in an ever-changing world?

Cumulative Emissions Will Determine Global Warming

Why the Decarbonisation Trajectory Alone Provides an Incomplete Picture

Many investors believe that in order to reach the 1.5°C target, an investment product needs to follow the PAB trajectory (purple, Figure 2). The deviation of the PAB trajectory from the 1.5°C trajectory (yellow, Figure 2), stems from the initial 50% reduction, which was built in by the EU TEG as a safeguard. Strictly speaking, Paris Alignment can be achieved without the initial reduction, but other trajectories, even if aligned with the end goal of no more than 1.5°C global warming, are often perceived as not compatible with the letter of the regulation. This confusion around alignment with the PAB trajectory versus the 1.5°C target can have far reaching repercussions, stifling innovation in sustainable investment management, and limiting the choice for climate-conscious investors.

Take for example the trajectory of an investment product that achieves an initial emission intensity reduction of 60% relative to the investable universe. Assume that in subsequent years, the portfolio will be constructed such that it maintains the emission intensity achieved in the base year. The emission reduction trajectory would be flat as depicted in Figure 3.

“This confusion around alignment with the PAB trajectory versus the 1.5°C target can have far reaching repercussions, stifling innovation in sustainable investment management, and limiting the choice for climate-conscious investors”

In terms of trajectory, it would appear as if the portfolio were unable to achieve the ambitious 1.5°C target. However, the extent of global warming will be determined by the cumulative emissions in the atmosphere. As such, in Figure 4, we highlight the cumulative emissions of the decarbonisation trajectories from Figure 3.

“…, the extent of global warming will be determined by the cumulative emissions in the atmosphere.”

A portfolio that achieves an initial emission intensity reduction of 60%, and that subsequently keeps its emission footprint stable over time without additional annual self-decarbonisation, would be equivalent, in terms of emitted cumulative GHG emissions, to IPCC’s recommended 7% year-on-year decarbonisation of the economy. In fact, from an environmental science point of view, emissions saved today are more valuable than emissions saved in the future due to their environmental knock-on effects. ‘The Time Value of Carbon’ written by my colleague Jamie Padkin provides a more detailed explanation of this effect. If innovation allows for a greater initial industry-wide reduction followed by a slower yearly decarbonisation rate, this should be encouraged.

Strictly speaking, any portfolio with cumulative emissions below the yellow line would adhere to the 1.5°C Paris Agreement. The 50% plus 7% year-on-year benchmark trajectory should not become the defining criteria in determining the Paris Alignment of a portfolio.

Following on from the earlier example of a portfolio with a 60% lower emission intensity than that of the investable universe in the base year, this portfolio would already agree with the 1.5°C target without further year-on-year reductions, as shown by the green line meeting the yellow line in Figure 4. In order to achieve the same outcome as a PAB, reducing intensities by 50% plus 7% year-on-year, the 60% product only needs to decarbonise at a yearly rate of 4.9%. In Figure 4, the green line would then meet the purple line. The outcome, in terms of total GHG emitted, is identical, but the construction deviates from the prescribed PAB rules. PABs offer one solution to aligning with the 1.5°C target. However, by prescribing the trajectory, the TEG removed the flexibility for the sustainable investment industry to innovate on its pathway to Paris. As other solutions will be developed, it would be to the detriment of the planet to dismiss innovations simply on the basis of their diverging decarbonisation trajectories.

“… emissions saved today are more valuable than emissions saved in the future due to their environmental knock-on effects.”

Importantly, the trajectory will have implications for portfolio construction and risk management. An inflexible trajectory can lead to unintended consequences for investors. Controlling for common factor risks when the real economy is not decarbonising at the required rate becomes increasingly difficult. Shifting focus to cumulative emissions offers additional degrees of freedom to investment managers in achieving their Paris targets, thereby allowing them to manage their carbon risk as well as traditional financial risks better. More on this later on.

While achieving the 1.5°C target is non-negotiable, there are important pitfalls that need to be carefully navigated on the journey to Paris Alignment.

Incentivising the Transition of High-Impact Sectors

There are too few companies that are currently Paris-aligned. As one index provider put it, “Today, 90% of the world’s public companies have an Implied Temperature Rise of above 1.5°C, making it exceedingly difficult for a diversified index, including a Paris Aligned Benchmark, to have an ITR of 1.5°C or 2°C at this point in time. In fact, a portfolio with an ITR of 1.5°C today would likely mean high concentration and a significant shifting of weights toward those few companies that already have an ITR of 1.5°C or below.”[ii] Building a Paris-aligned portfolio therefore becomes more challenging with every passing year where the real economy is not decarbonising at the prescribed rate of 7%.

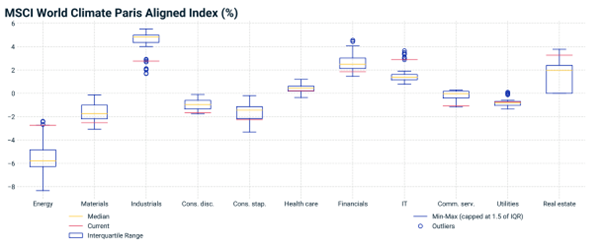

As demonstrated in Figure 5, to achieve the trajectory, Paris Aligned Benchmarks are currently forced to be actively under-weight high impact sectors, such as Energy, Materials, and Utilities, as a whole. Apart from a large over-weight in Industrials, other sector over-weights are in Information Technology, Financials, and Real estate. Real progress in fending off catastrophic climate change will, however, require tackling the largest emitters in high-impact sectors by encouraging them to transition to greener business models.

Given that on a stock level there are not enough companies to build a diversified PAB, the EU TEG recommends addressing the problem at the portfolio level by building an index that as a whole follows the 1.5°C decarbonisation rate, shifting index weights away from high intensity companies towards those with lower intensities.

In order to avoid greenwashing, the rule book contains the so-called ‘equity exposure constraint’ requiring intensity reductions to be achieved within sectors, not through the exclusion of intensive high impact sectors as a whole.

“… to achieve the trajectory, Paris Aligned Benchmarks are currently forced to be actively under-weight high impact sectors, such as Energy, Materials, and Utilities, as a whole.”

The constraint, however, applies to the aggregate of all high impact sectors. One could, for example, as we have seen above, divest from utilities and shift the weight to industrials such that the aggregate weight of the two sectors does not deviate from that of the benchmark.

There are two issues with this approach. First, the 7% year-on-year reduction rule is such that it becomes increasingly difficult to achieve it on an intra-sector basis if the real economy is not reducing its intensities fast enough. Second, reallocating capital between high impact sectors is questionable. Electricity generation is not comparable to industrial manufacturing even though both are intensive processes.

In practice, this means that there is a clear decoupling between the real economy and Paris Aligned Benchmarks. As one index provider stated, carbon intensity reductions in their benchmark are mainly driven by over-weights in Consumer Discretionary and Information Technology.[iii] Arguably, the rule book pushes you into a portfolio that will have less impact in effecting change and making true progress towards the Paris Agreement.

“What matters is the real cost of capital impact, not intensity reductions on paper in a portfolio that is not reflective of the real economy.”

If we are to achieve the 1.5°C target, we need to incentivise the worst polluting sectors to change. This can only be achieved by identifying and rewarding the environmental leaders and by penalising the environmental laggards in each sector. Divestment of whole sectors does not only remove the option to shift capital to transitioning companies, it also removes the ability to effect change through active engagement. We need to hold companies accountable across the economy, even if that requires renouncing the prescribed 7% year-on-year emission reductions at times. What matters is the real cost of capital impact, not intensity reductions on paper in a portfolio that is not reflective of the real economy.

Decoupling From the Real Economy

Hedging Climate Risk at the Cost of Increased Active Risk

Not only do investors jeopardise environmental impact by tracking PABs unquestioningly, but they also take unintended bets which risk leaving them worse off financially as well. Traditional risk management is as important as climate risk management if we are to safeguard future generations’ money and planet.

The EU TEG states that PABs should allow investors to hedge against climate transition risks as well as direct their investments towards energy transition opportunities. Given where the sector exposures of PABs lie today, one might argue that overexposure to Information Technology hardly shifts the transition needle. A true hedge with real impact would offset an under-weight position in the dirtiest fossil energy electricity generator with an over-weight position in the greenest clean-energy electricity producer. The same rationale applies to all other sectors.

“Active risk, in terms of deviation from the investable universe reflecting the economy and resulting risk factor exposures are indiscriminately accepted as collateral damage.”

As a consequence of the rigid focus on the year-on-year decarbonisation requirement, the prescribed carbon footprint is determining the final portfolio. Active risk, in terms of deviation from the investable universe reflecting the economy and resulting risk factor exposures are indiscriminately accepted as collateral damage. Investors in many ESG products have come to feel the pinch of this blind acceptance of traditional financial risks in the first half of 2022. Rising commodity prices have benefitted industries that have long been shunned by the sustainable investment community and tech stocks that have long dominated their portfolios have seen a collapse in their prices in the face of macroeconomic headwinds.

A portfolio aiming for environmental and financial impact would target the best companies in every sector letting the resulting portfolio determine the carbon footprint while actively managing portfolio risks. The achieved footprint would reflect the most sustainable state of the current economy incentivising real change going forward. Following this approach, one would stand a chance in setting the real economy on the decarbonisation trajectory required to align with the 1.5°C target.

Detrimental Technical Design Flaws

Enterprise Value Including Cash – The Illusion of Impact

Inbuilt design flaws of PABs hamper environmental impact.

The EU TEG prescribed the use of Enterprise Value Including Cash (EVIC) as denominator when calculating GHG intensities. The rationale originates from the expert groups’ concern that denominators such as revenue would unreasonably favour companies in high-revenue-generating sectors even though their assets will become stranded. This concern is unjustified when comparing companies within their sectors, which is incentivising economy-wide decarbonisation, as argued above.

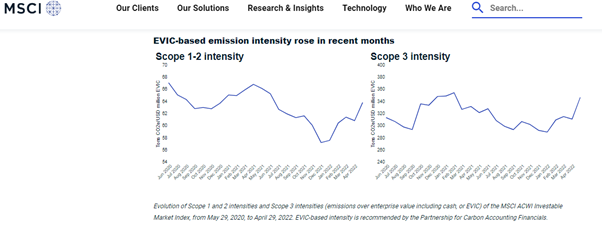

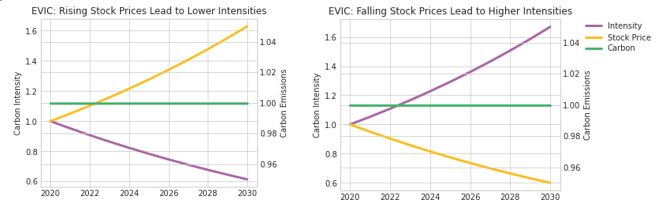

Moreover, the calculation of EVIC incorporates the market capitalisation of companies. Not only does this introduce unjustified volatility in carbon intensities leading to turnover in index constituents driven by stock price fluctuations that are unrelated to corporate production, it also unfairly benefits growth stocks. The reliance on EVIC also risks misleading investors on portfolio environmental footprints. For instance, index providers had to explain recently that the pollution level of their indices did not increase even though their EVIC-based intensities had been rising (see Figure 6).[iv]

As illustrated in Figure 7, rising stock prices without changes in corporate emissions would lead to an unjustified fall in intensities without underlying reductions in carbon emissions. The opposite effect would be true during a bear market when stock prices are falling.

Taken to the extreme, in absence of adjustments to the minimum level of decarbonisation, the Paris Alignment trajectory of 7% year-on-year could simply be achieved by continuous rises in equity prices in excess of 7.53% annually.

To be fair, the EU rule book states that the minimum level of decarbonisation should be increased if enterprise values inflate. In recent history, we have seen the market capitalisation, and therefore the weight, of the most intensive sectors in benchmarks increase on the back of commodity price rallies. Increasing the minimum level of decarbonisation during periods of rising enterprise values escalates the tracking error and active risk, thereby further aggravating the decoupling of PABs from the real economy.

Overall, EVIC as a denominator adds an unnecessary level of complexity that could be avoided altogether when applying a production-related denominator to contrast companies to their sector peers.

Scope 3 – Estimation Overpowers Reality

Design flaws could further impede financial payoffs for investors.

PABs require an incremental phase-in of Scope 3 emissions into intensity calculations. At face value, taking Scope 3 emissions into consideration is important as they account for the vast majority of global corporate emissions. However, mandating the phase-in of estimated data risks overpowering actual reported data.

“The result are indices that effectively assign higher importance to estimated data over reported data thereby discounting reality in favour of fabrication.”

To date, corporate GHG disclosure focuses largely on Scope 1 (direct) and Scope 2 (indirect) emissions, but often lacks coverage and detail of Scope 3 (other indirect) emissions despite the latter generally being the larger source of emissions. Scope 3 accounts for about 85% of total emissions, while Scope 1 and 2 make up only 15%.

Given poor disclosure, the TEG encourages Scope 3 emissions to be estimated based on firm and sector characteristics. Index providers resort to estimation models to fulfil the phase in requirement. The result are indices that effectively assign higher importance to estimated data over reported data thereby discounting reality in favour of fabrication.

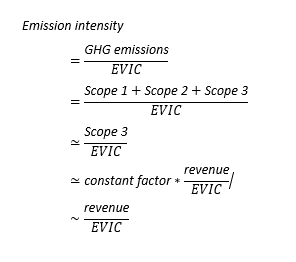

Moreover, current estimated Scope 3 emissions data are deeply flawed. As forthcoming research by my colleague Lennart Hermans demonstrates, data providers’ Scope 3 estimations can be largely traced back to being derived from firm revenue x industry emission factor. The emission factor can be thought of as a constant.

If a firm’s intensity is computed as Scope 1 + 2 + 3 emissions / EVIC then effectively Scope 1 and 2 emissions matter little given their small magnitude compared to Scope 3 emissions. The intensity is thus largely dependent on estimated Scope 3 emissions, which can be simplified to constant emissions factor x (revenue / EVIC).

Given that PABs actively seek to reduce emission intensities calculated as described above, the index construction rules will minimise revenue/EVIC thereby pushing investors into portfolios with low revenue generating companies.

Not only is this self-defeating from an investment perspective, but it is also inconsequential from an environmental perspective. Until Scope 3 data is disclosed in sufficient quality and quantity, mandating the inclusion of estimated data in investment products is counterproductive.

Conclusion

Environmental Impact on Paper Alone Will Not Change the Real Economy

There is no questioning the merits of having a 1.5°C Paris target and the investment community should actively work towards its achievement.

Nonetheless, well-meaning rules should not stifle innovation in investment products of index providers and asset managers alike.

While Paris Aligned Benchmarks cast the spotlight on the rate of decarbonisation of indices, the trajectory of decarbonisation alone should not become the sole defining criteria to establish Paris Alignment. Reductions in total cumulative greenhouse gases emitted over time are decisive. By means of example, a 60% decarbonisation today while maintaining intensities at that level going forward is superior to a 7% year-on-year reduction. Both would stay within the maximum allowance prescribed by the 1.5°C target, but the former provides additional protection from environmental knock-on effects. Focusing on cumulative emissions will provide additional degrees of freedom in constructing Paris aligned portfolios.

We also need to prevent a decoupling of Paris Aligned Benchmarks from the real economy. Prescribing a 7% year-on-year decarbonisation of portfolios when the real economy, including high impact sectors, are not reducing emissions at a steady pace will not incentivise true change and could lead to strongly biased investment products that neither benefit investors nor the environment.

Companies begin their journey to Paris Alignment from different starting points. Their paths depend on how far they need to travel from their current business models to reach alignment with the 1.5°C target. For some, it will be a relatively easy transition, for others, the decarbonisation will be much more difficult to achieve. A best-in-class approach in each sector encourages companies from all starting points to make incremental changes towards a more sustainable future. Building an economy-wide risk-controlled Paris aligned portfolio that encourages the transition to a 1.5°C world is possible but requires steering the portfolio away from detrimental unintended consequences that negate positive environmental impact.

[i] Source : https://www.msci.com/www/blog-posts/are-emissions-rising-or-falling/03250417569?utm_source=esg&utm_medium=email&utm_campaign=net-zero-newsletter-06-27-2022

[ii] Source: S&P Dow Jones Indices. Index Investment Strategy: Climate & ESG Index Dashboard. Q2 2022.

[iii] Source: https://www.msci.com/our-solutions/climate-investing/climate-indexes/eu-paris-aligned-benchmark

[iv] Source: https://www.unep.org/news-and-stories/press-release/cut-global-emissions-76-percent-every-year-next-decade-meet-15degc