Osmosis Quarterly Investment Review and Outlook – June 30, 2023

Robbie Parker, CFA

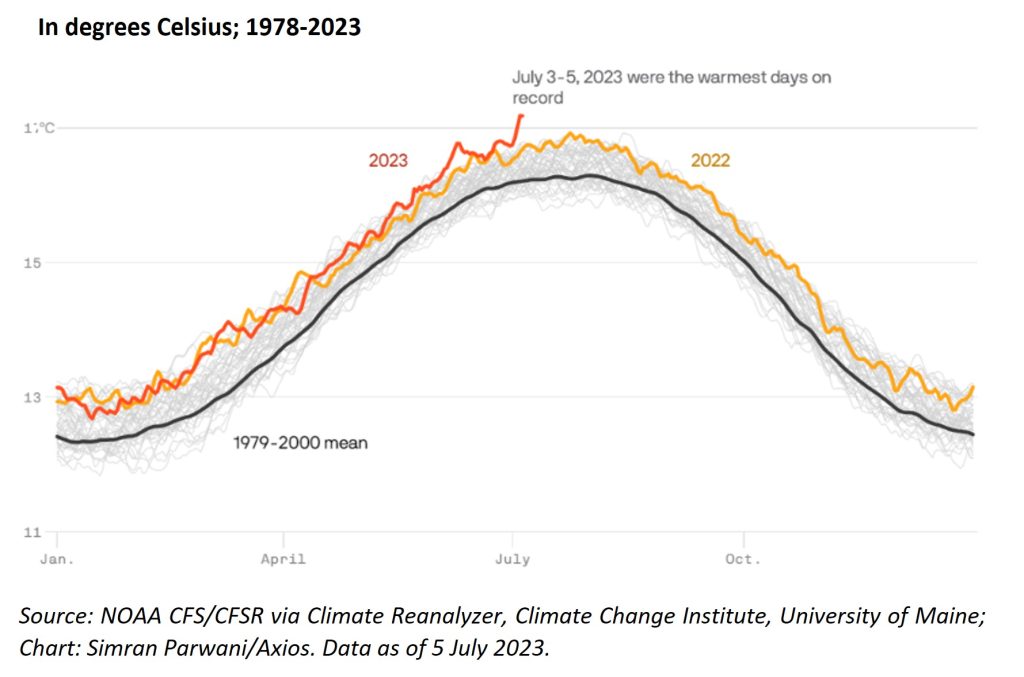

Sitting in Tokyo, as the ‘feels-like temperature’ reaches 46 degrees Celsius and with humidity greater than 60%, I am experiencing firsthand that some of the warmest days on record are being surpassed. Asia is not alone in recording record-breaking heat this year; warnings are being announced across Europe and North Africa while extreme flooding in the Northeast of the US ensues. These events, which are increasing in number and magnitude, serve as a stark reminder to us all that climate change brings with it unquantifiable risks and implications that simply cannot go ignored.

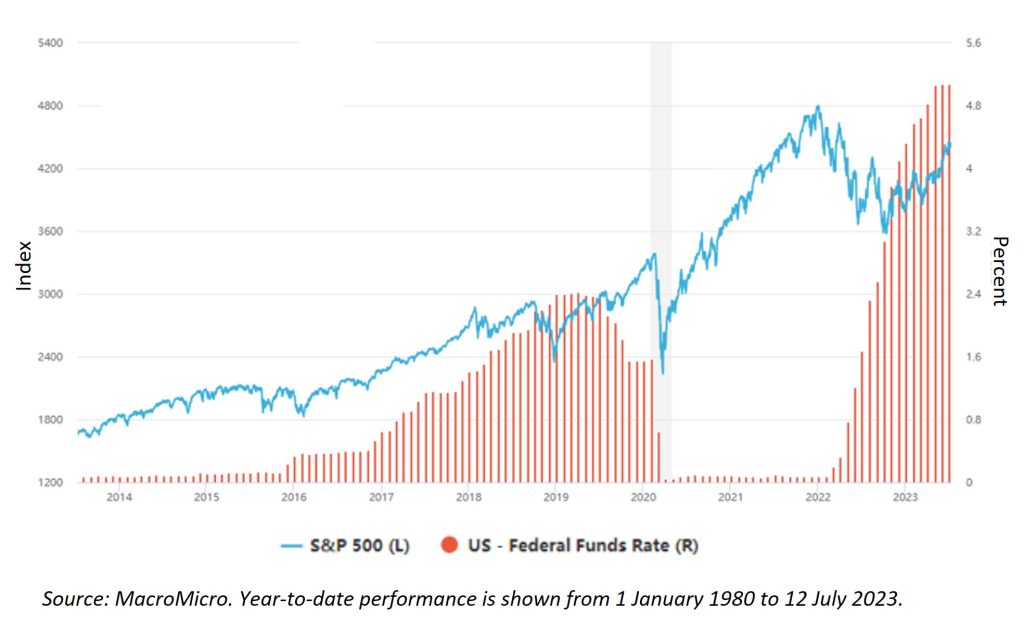

The stock markets appear to be doing just that, however. Stock prices have also soared year to date, with investors shrugging off the effects of global interest rate rises, stubborn inflation in Europe, and the threat of another energy crisis as we approach the winter months in a continent still dealing with the complexities of the war in Ukraine. In USD TR terms, the S&P 500, Euro Stoxx 50, and Nikkei 225 have rallied 16.9%, 20.7%, and 16.5% respectively.

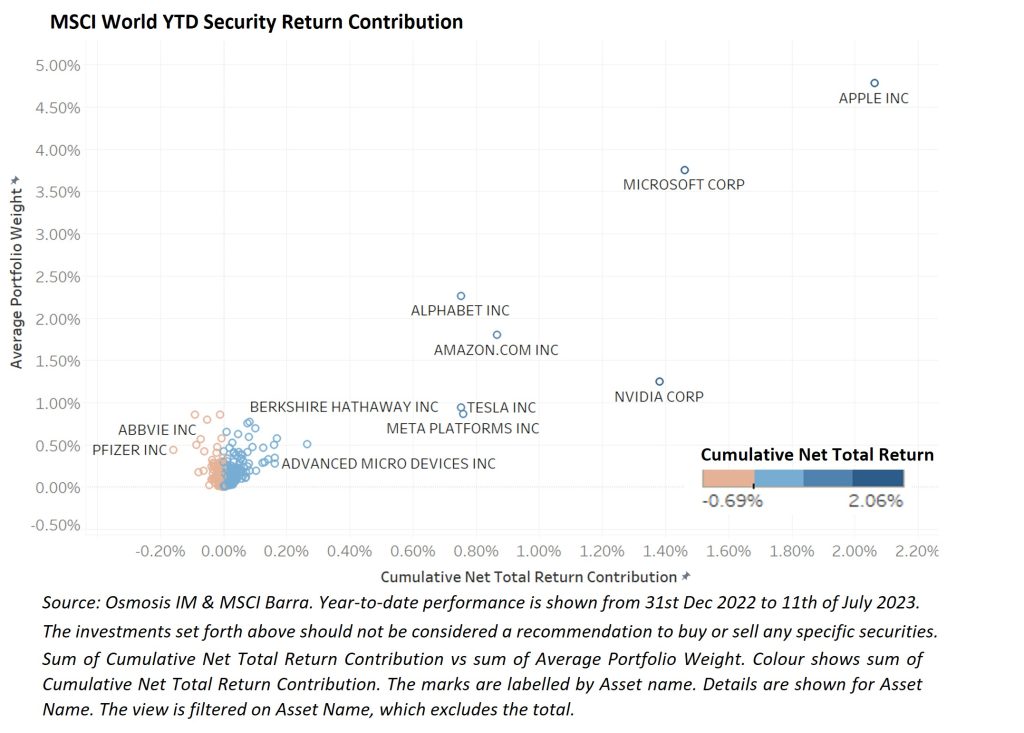

But are investors really ignoring the fundamentals? Lifting the lid on the recent rally we can see that the positive contribution to returns is largely concentrated in a few large-cap, technology names that have excessively outperformed relative to the overall market. The usual suspects including Apple, Microsoft, Nvidia, Meta and Alphabet have been the predominant contributors. The upcoming ‘special rebalance’ of the Nasdaq indices is further evidence that a handful of names is distorting the health of the market. Intra-day volatility has already applied some short-term pressure on the performance of these behemoths’ as changes to the index will force investment funds to adjust their portfolios accordingly. Who knew index providers were now openly dabbling in active management?

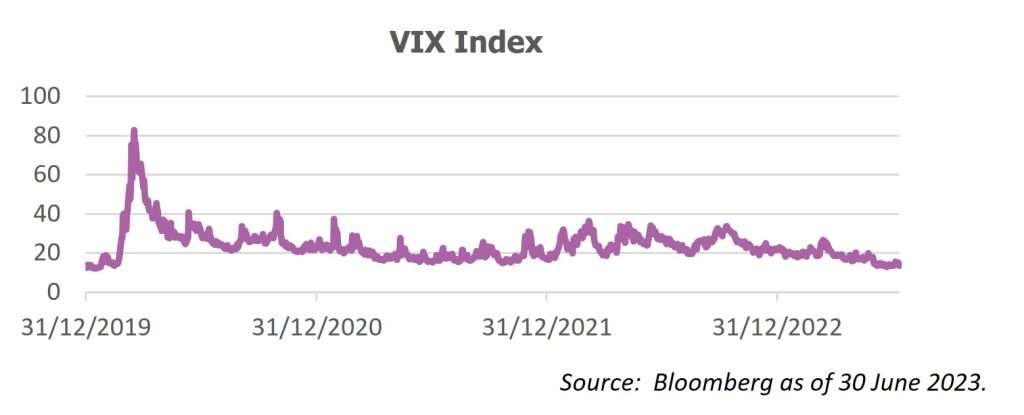

Volatility looks set to be the theme going forward despite the VIX index trending lower to levels last seen pre-covid. As regional inflation adjusts and monetary policy deviates worldwide, we will see large movements in both currency and country effects. In tandem, as the world resets to this new interest rate paradigm, we believe that inter stock volatility will rise as fundamentals return as the main drivers of stock performance.

The climate catastrophe is not going away. Public equity portfolios are hugely vulnerable to the future physical effects of climate change as well as changing policy and regulation. Amid growing evidence that those companies taking tangible steps to reduce environmental risk will enjoy a lower cost of capital, and a structural competitive advantage over time, there has never been a greater need to address environmental risks at a portfolio level. Waiting patiently for the long-term opportunities to play through is a precarious game, investors should look to short-term risk management for survival.