While setting an internal carbon price is a helpful practice, its usefulness will depend on how high or low that price has been set.

Earlier research published by Osmosis (Cost of Carbon) demonstrated that inefficient companies, as measured through the proprietary Resource Efficiency factor, are more at risk of external carbon pricing. The effects of even a moderate carbon price will likely be more damaging to those companies on the inefficient side of our distribution. [1]

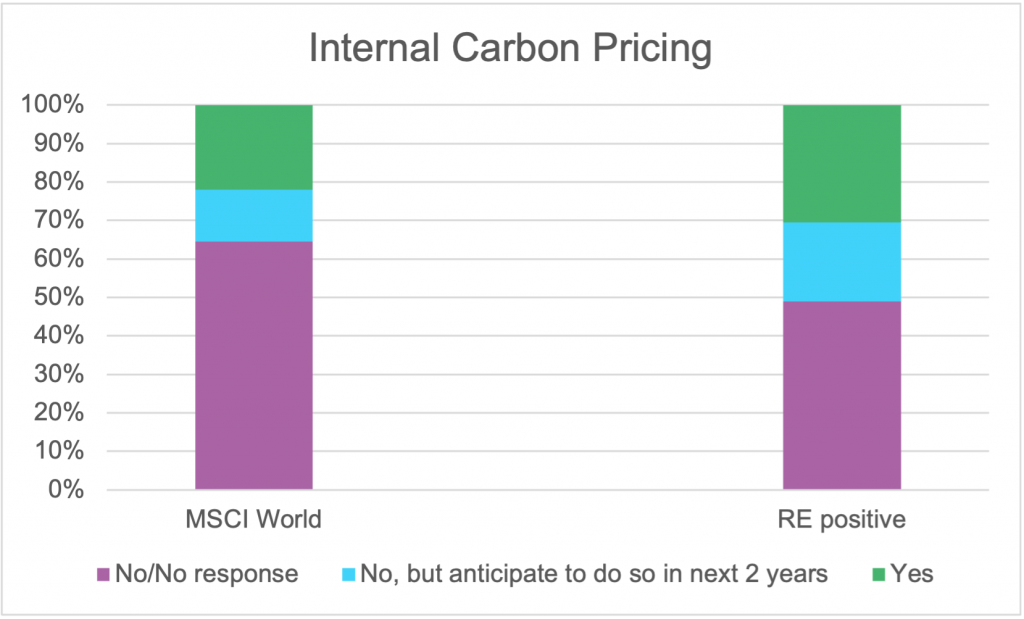

Further research shows that not only are efficient companies better placed to adapt to external carbon pricing mechanisms, many are already proactively pricing carbon within their own operations. Over 30% of RE positive stocks disclose they use an internal price on carbon, with an additional 20% planning to do so in the next two years. This contrasts to only 22% of companies within the MSCI World using such mechanisms, with 13% aiming to implement it in the near future.

While external carbon pricing is imposed on companies by governments, internal prices are implemented by companies within their own operations to better manage their carbon profile. An internal carbon price can help manage upcoming regulations as well as reveal low-carbon opportunities to companies.

Assigning an internal price to carbon comes in many different forms. Koninklijke Philips has introduced a EUR50/tCO2e shadow price in their investment requisition tool for relevant operation, real estate, IT and energy-related investments. Emissions associated with these investments are calculated using the shadow price and integrated in the total cost of investment to allow for a meaningful comparison to be made with alternative solutions. [2]

Unilever plc went further and set an actual internal carbon price of EUR50/tCO2e across all of its manufacturing facilities, which helped create the internal clean energy fund. This fund uses the money generated by the internal carbon price to fund renewable energy projects and is part of the group’s annual CAPEX budget. [3]

A more common way to implement an internal carbon price is to use voluntary carbon markets to offset emissions. Amadeus IT Group for example, after moving to make their data centres run on 100% renewable energy, purchases offsets for their remaining emissions linked to operations, facilities and business travel. While Osmosis’ Model of Resource Efficiency doesn’t consider offsets in its model, we believe that this form of internal carbon pricing can incentivise corporations to reduce their emissions in the future. [4]

While we see internal carbon pricing being implemented in every sector of the economy, there’s clearly more uptake in some sectors than others. Unsurprisingly, the heavy emitting sectors such as Electricity and Multi-Utilities have the highest adoption rates, with up to 70-80% of companies within these sectors setting some form of internal carbon price. Even in less obvious sectors such as Food Producers and Beverages, one in four companies has set an internal price on carbon.

While setting an internal carbon price is a helpful practice, its usefulness will clearly depend on how high or low that price has been set. To ensure that establishing an internal carbon price makes long-term investments more resilient and future-proof, the price should reflect future carbon costs rather than the current price. Unfortunately, our analysis shows that in over 42% of cases, the internal price is lower than USD25, and in almost 70% of cases doesn’t reach USD50, which is lower than the current carbon price in the European carbon market. Corporate projects that have been actioned using these low prices are still at risk of becoming unviable in the future should a more realistic price of carbon be incorporated.

- https://www.osmosisim.com/2021/10/13/the-cost-of-carbon/

- KPN NV Climate Change 2021 CDP Disclosure, C11.3, C11.3a;

- Unilever plc Climate Change 2021 CDP Disclosure, C11.3, C11.3a;

- Amadeus IT Group Climate Change 2021 CDP Disclosure, C11.3, C11.3a

The examples of specific investments described herein should not be considered a recommendation to buy or sell any specific securities. There can be no assurance that such investments will be purchased in a client’s portfolio. It should not be assumed that any of the investments identified in these case studies will be profitable in the future. Whilst the information contained herein is believed to be accurate, no representation or warranty, express or implied, is or will be made, and no responsibility or liability is or will be accepted by Osmosis, or by any of its officers, employees or agents, in relation to the accuracy or completeness of this document or of any information contained within it.