Osmosis Quarterly Economic Review and Outlook – December 31, 2023

Following one of the most aggressive tightening campaigns in recent history, the markets were met in December with a long-awaited shift in the US Federal Reserve’s monetary policy. The S&P, Eurostoxx, and Nikkei rallied 16%, 13%, and 8% respectively from the 27th of October (dividend reinvested) to the year end. Economists now widely anticipate that 2024 will see looser monetary policy globally, with some predicting policymakers will cut rates the most since the financial crisis in 2008.

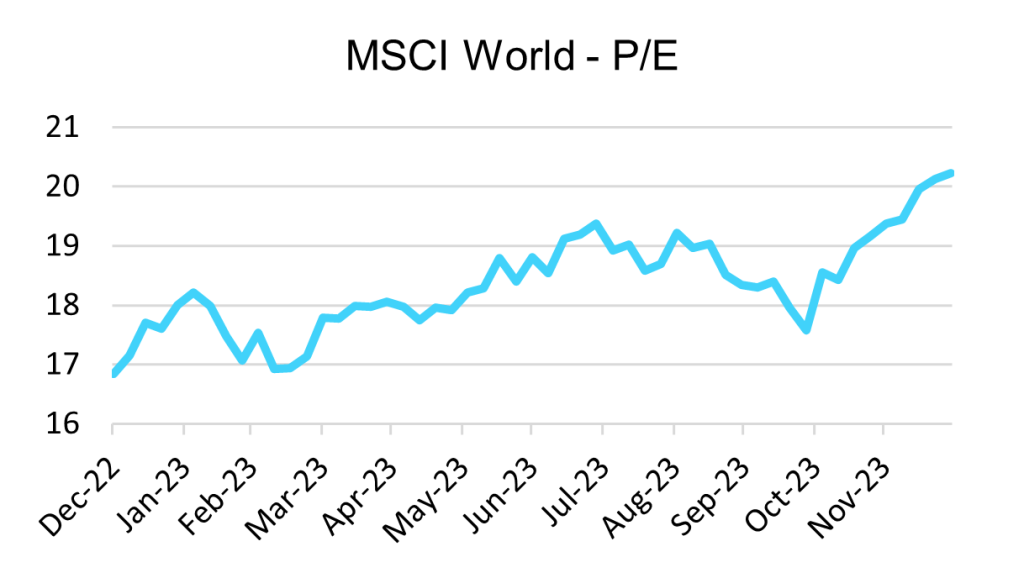

The ensuing year-end rally in equity markets continued to have little to do with fundamentals. As can be seen by the graph below, gains were almost entirely related to a re-pricing of the general equity markets. The beginning of the year commenced with a P/E of 16.8x, equating to a yield of almost 6%, yet by the end of the year, the P/E of the MSCI World was 20.2x, a yield of less than 5%.

Source Bloomberg, data as of 31st December 2023.

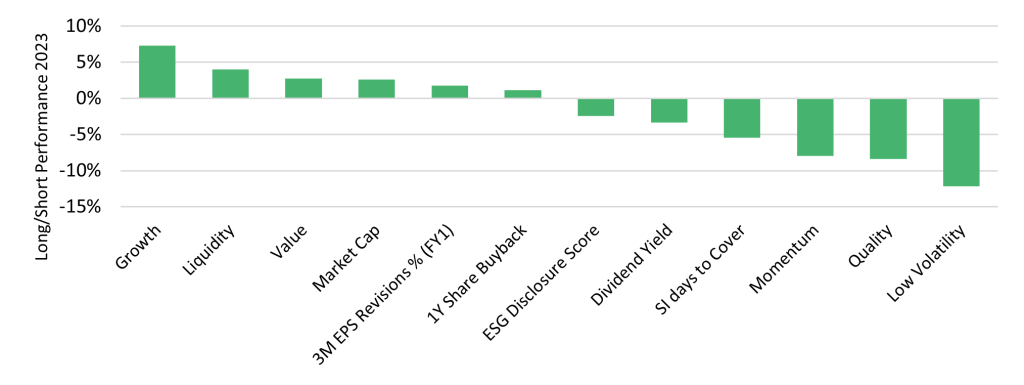

On a sector-relative basis, we saw both the growth and value stocks outperform (when comparing the top quintile of each factor relative to the bottom quintile). Conversely, we saw momentum, quality, and low volatility all perform negatively for the year.

Source Bloomberg, data as of 31st December 2023.

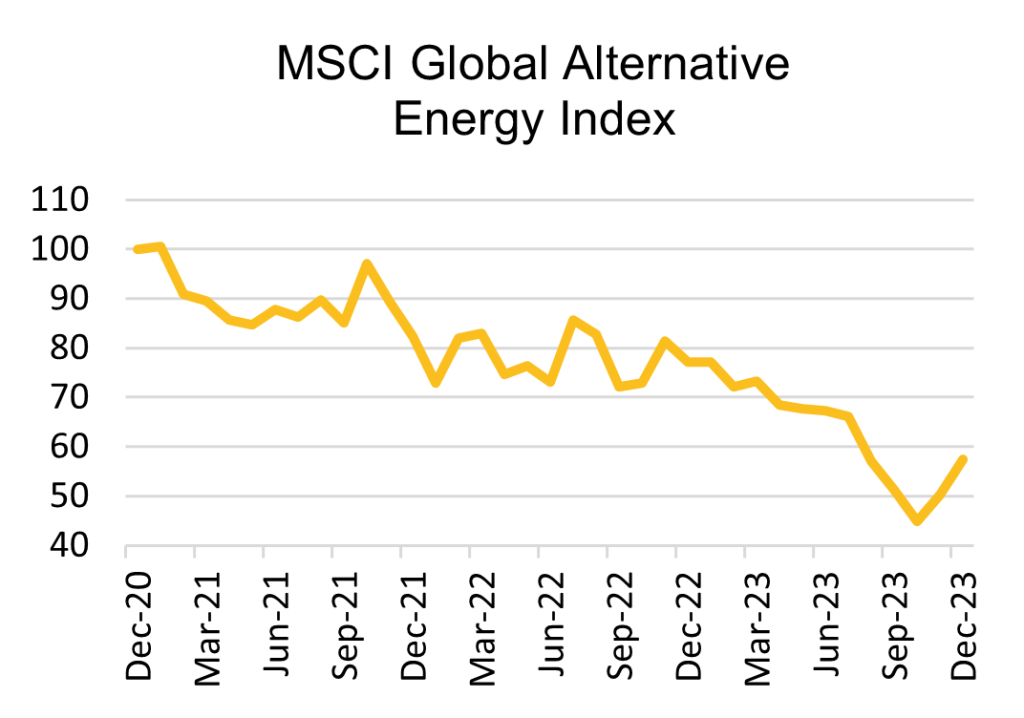

Certain sectors will inevitably emerge as key beneficiaries in an interest rate-cutting cycle, and any cuts in 2024 will likely be very positive for the renewables industry. The sector should further benefit from a consensus to move away from fossil fuel-based energy as agreed at November’s controversial COP 28 in Dubai, the UAE’s second-largest oil producer. Despite rumours of the host negotiating oil/gas contracts in the background, there were further commitments to renewable energy generation as well as energy efficiency measures.

Of course, such commitments will not be simple. Protecting our planet requires unprecedented large-scale investments in technical innovations and renewable energies if we are to meet our net zero targets and keep below a 2-degree rise in global temperatures. The last few years have demonstrated that green projects requiring high upfront capital investment have been heavily penalised and the viability of such projects has been called into question. The thematic saw a revival during the end of last quarter but this ultimately shows how sensitive to rates it remains.

Source: The data shown above is from the NGEAE Index as of 31 December 2023, Bloomberg.

Ultimately though, the longer the can is pushed down the road from such Climate agreements, the more painful the final resolution that will be required. In the meantime, there is a simpler way to hedge such risks which is through the identification of sustainable, forward-looking management teams that are future-proofing their businesses. Not only are these businesses more profitable, but they also have less debt, allowing for greater flexibility as short-term rates drive net profit margins over the next 3-5 years, and more flexibility to invest for the future. We all know it will be greatly needed!

The investment examples stated above should not be considered a recommendation to buy or sell any specific security.