Emerging markets disclosure rates are increasing much faster than developed markets, and are set to catch up in the next few years, writes Lily Andrews, a Research Analyst at Osmosis IM.

- Osmosis has been surprised at just how far the regions have come and the pace at which the overall picture is improving

- Osmosis is now preparing our first investable emerging markets products for launch

- In both DM and EM alike, increasing pressure from regulators and investors is rapidly improving reporting rates

Seven years ago, Osmosis Investment Management received a client request to launch a Resource-efficient emerging market (EM) strategy. The firm’s specialist environmental research team concluded, however, that the environmental data available in EM was not fit for the purposes of allocating risk. The data was limited in breadth, the quality was sub-optimal, and the estimation models used by many of the third-party data vendors resulted in skewed distributions.

Osmosis felt that to construct portfolios from this data would lead to a misallocation of risk and any subsequent environmental footprints would be rendered meaningless. The firm therefore declined the opportunity.

Today, the data landscape has changed and Osmosis has just concluded a 16-month research project into corporate environmental data in EM, which included hiring a dedicated team of analysts to collect, extrapolate, clean, and standardise publicly available carbon, water, and waste data on a sector by sector basis across the whole economy. Osmosis has been surprised at just how far the regions have come and the pace at which the overall picture is improving.

Lily Andrews, Research Analyst at Osmosis IM:

“The findings have comfortably exceeded our expectations. Not only are we confident that there is enough depth, breadth, and consistency in the data, but our quantitative research team has also been able to evidence a sustainable alpha signal comparable to that identified in our developed market products. As such we are preparing our first investable emerging markets products for launch.”

Following the project, the team claims to have more than doubled the number of carbon data points as some well-known third-party data providers. Osmosis is also confident that its extensive water and waste data points give it a leading edge compared to its peer group, especially given the tendency of companies and investors to overlook this data due to a focus on carbon reporting. Having sourced and verified all its data from publicly available company reports, with no reliance on third-party or estimated data, the firm is confident that its data points are objective and trustworthy. Since its inception, Osmosis has invested heavily in building out its proprietary research function and prioritises engagement with management teams to ensure a comprehensive understanding of how environmental data interacts with a particular company’s business models.

Scope for Greater Environmental Improvements

The scope for significant environmental improvements in these regions was a key incentive for Osmosis when embarking on this research project over a year ago.

The firm anticipated higher carbon, waste, and water intensities compared to the DM, attributable to factors such as increased reliance on fossil fuels, nascent waste regulations, and inadequate water security and infrastructure.

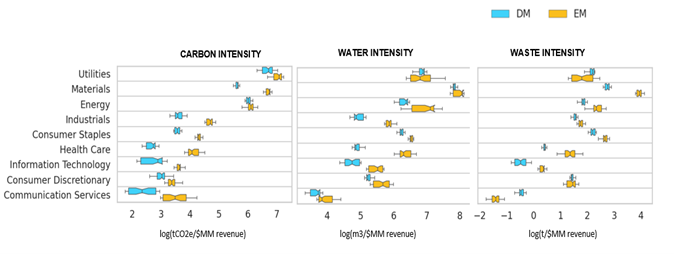

Osmosis’ research affirmed its expectations, revealing greater sectoral intensities in the EM compared to the DM, as illustrated in the chart below, and thus potential for greater savings, with the most efficient EM matching their DM peers and the least efficient trailing significantly.

Osmosis argues that addressing these challenges could surpass the environmental footprint reductions it currently achieves in the DM, with the potential to yield considerably more impact.

Increasing the Environmental Impact per Dollar

Source: The analysis is based on fully disclosing companies. The sample period for the analysis ranges from 31/08/2019 to 31/10/2023. Source: Osmosis IM. Data as of end November 2023.

Broadening the whole economy approach

Osmosis’s whole economy approach rewards environmental leaders and penalises laggards across broad market sectors. This approach recognises that completely excluding heavy industries, vital to our socioeconomic systems, will not facilitate a smooth transition to a more sustainable economy. By broadening the firm’s coverage to include EM it hopes to continue to encourage and reward positive and innovative environmental practices in different regions and sectors.

Research, such as that by Baumert et.al , argues that in the last three decades, developed economies like the US, UK, Canada, and Australia are increasingly outsourcing their emissions to less developed regions with lower climate ambitions, through shifting their production to less carbon-intensive goods and increasing imports of carbon-intensive products.*

Osmosis believes it is therefore paramount to consider the environmental performance of nations now burdened with these emission increases. The firm aims to facilitate the flow of capital into high environmentally performing entities, in carbon-intensive sectors and regions, to aid the global transition to a low-carbon economy.

*Source: Nicolai Baumert, Astrid Kander, Magnus Jiborn, Viktoras Kulionis, Tobias Nielsen, Global outsourcing of carbon emissions 1995–2009: A reassessment, Environmental Science & Policy, Volume 92, 2019, Pages 228-236.

Data quantity is only slightly behind DM counterparts.

Osmosis has found the quantity of data in the EM to be only slightly lagging, at ~15% behind that of the DM.**

The firm considers three key environmental metrics in its research: carbon emissions, water consumption, and waste generated. To be considered for any of Osmosis’s portfolios, companies need to report at least two of these metrics.

Osmosis’ strategies exclude financial sectors, leaving a starting universe of ~1100 companies of which almost 700 EM companies can be classified as partial or full disclosers.**

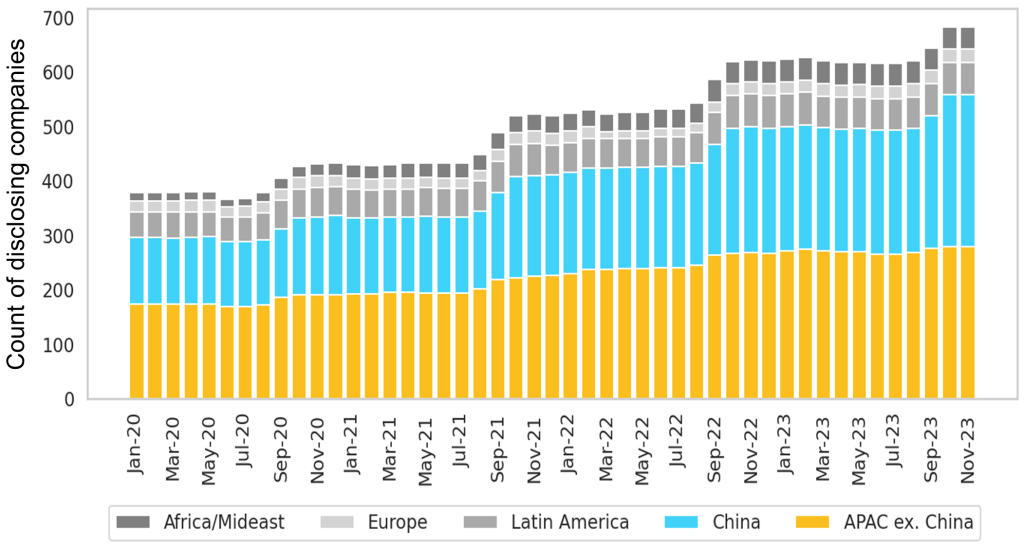

Osmosis research shows that since the advent of this decade, there has been an exponential rise in disclosure, as illustrated by the chart below, which represents disclosing company count by region.

In both DM and EM alike, increasing pressure from regulators and investors is rapidly improving reporting rates. Osmosis’s research suggests that EM disclosure rates are increasing much faster than DM, and that EM disclosure rates will catch their DM peers in the next few years.

**Source: Osmosis IM. Data as at end November 2023

Rapid Increase in Emerging Market Disclosure Levels

Source: Osmosis Investment Management, data is given as of 30 November 2023

Concerns regarding the quantity of Chinese disclosure are largely unfounded.

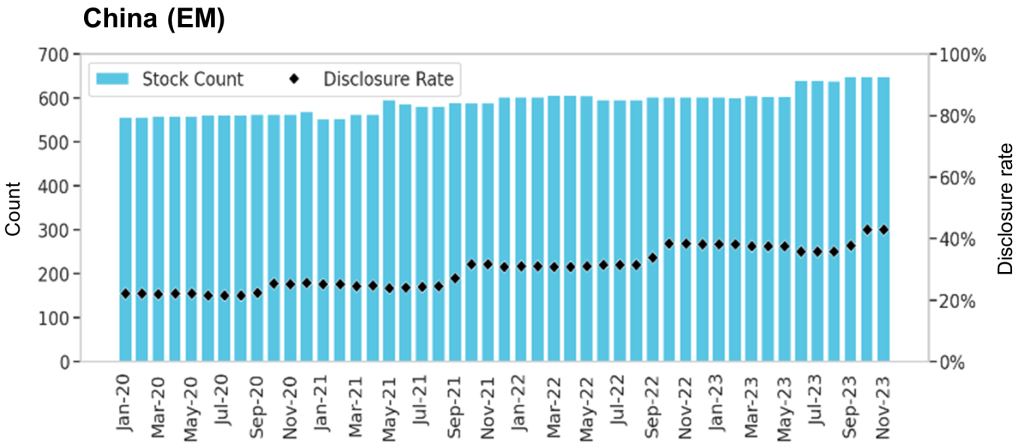

China has always been a point of interest for sustainable investors. Representing 53% of the EM index by count, its market dominance and lower environmental disclosure rates have proven a deterrent for investors. However, Osmosis suggests such concerns are largely unfounded.

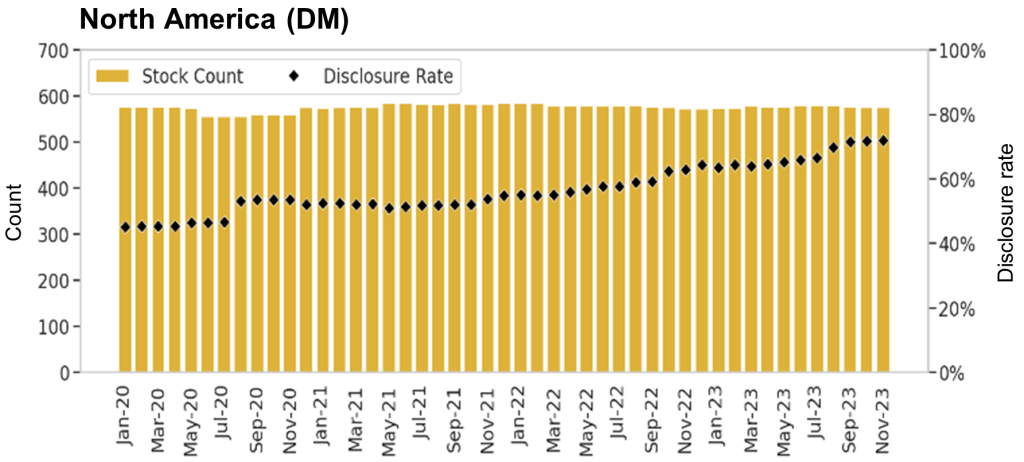

The firm’s research indicates that parallels can be drawn between DM and EM on a regional basis, with historic disclosure trends in North America strongly aligning with current patterns in China. Chinese disclosure rates are currently low, sitting at just above 40%. This is not dissimilar to the disclosure rates of North America in 2020, illustrated by the charts below which compare recent disclosure counts in the two regions. Furthermore, it is particularly notable that

Chinese disclosure rates are higher than North American rates were in 2017 when Osmosis launched its flagship Core Equity Fund.**

Chinese disclosure rates are also expected to increase rapidly. Last month, the country’s three largest stock exchanges announced the publication of new sustainability reporting guidelines for listed companies, including a mandatory requirement for hundreds of larger cap and dual-listed issuers to begin disclosure on a broad range of ESG topics in 2026.

Comparison of Recent North American and Chinese Disclosure Rate

Source: Osmosis Investment Management, data is given as of 30 November 2023

Sustainability disclosure in EM is of a similar quality to that of the DM.

Of course, disclosure of such data does not guarantee accuracy or trust. However, following extensive scrutiny and data analysis, Osmosis’ research suggests that the quality of sustainability disclosure in EM is similar to that of the DM.

On an index level, their environmental and quantitative teams compared environmental intensity values between the two markets, finding that EM performance was only slightly behind their DM peers. A promising outcome that indicated the use of similar measurement and reporting processes.

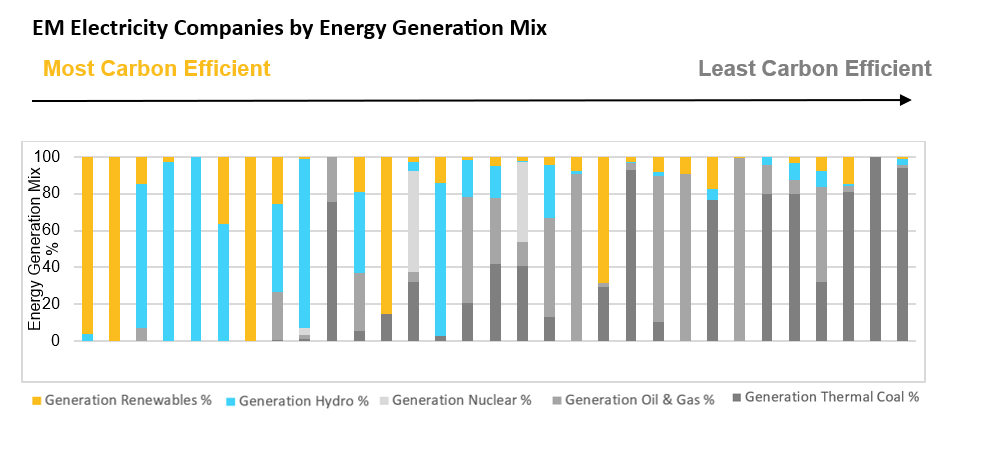

At a sector and stock level, Osmosis utilised both broad analysis techniques, such as reviewing outliers and comparing year-on-year value changes, as well as sector-specific methods to further test the reliability of the data. An example of the latter, shown in the chart below, was conducted by overlaying the energy mix and emissions data of electricity producers.

The expectation of electricity production is that entities reliant on fossil fuels like oil, gas, and thermal coal for generation will have higher emissions than those that utilise hydro or renewables. Any significant divergence from this could suggest a misrepresentation or even greenwashing of carbon data.

This chart illustrates how Osmosis found this dispersion to hold true, but there were outliers. As with companies in the DM space, Osmosis is committed to engaging with entities on any heterogeneous data points and any companies that do not fit sector or company trends become a part of active ongoing engagement. To maintain the accuracy and integrity of the firm’s investment model, any data points will be excluded from the database if a good explanation is not found. To maintain the accuracy and integrity of the firm’s investment model, any data points will be excluded from the database if a good explanation is not found.

Conclusion

Osmosis was surprised by the strikingly high quality, comparability, and rates of environmental reporting in the EM. The firm points to the consistent use of globally recognised frameworks like GRI, SASB, and TCFD throughout EM regions as a likely contributor.

Many local regulatory bodies and stock exchanges in key EM jurisdictions mandate entities to report in line with these frameworks, often at a rate that is more advanced than we see in the DM.

Based on its findings, Osmosis has been able to prove out a sustainable factor in the EM, just as they did over 10 years ago in the DM space. The firm will be launching an EM product suite in the second half of the year having secured initial seed from an institutional investor.

Important Information

This document was prepared and issued by Osmosis Investment Research Solutions Limited (“OIRS”). OIRS is an affiliate of Osmosis Investment Management US LLC (regulated in the US by the SEC) and Osmosis Investment Management UK Limited (regulated in the UK by the FCA). OIRS and these affiliated companies are wholly owned by Osmosis (Holdings) Limited (“Osmosis”), a UK-based financial services group. Osmosis has been operating its Model of Resource Efficiency since 2011.

None of the company examples referred to above are intended as a recommendation to buy or sell securities.

The information is intended only for the use of eligible and qualified clients and is not intended for retail clients. The information does not constitute an offer or solicitation for the purchase or sale of any security, commodity or other investment product or investment agreement, or any other contract, agreement, or structure whatsoever. Recipients are responsible for making your own independent appraisal of and investigations into the products referred and not rely on any information as constituting investment advice. Investments like these are not suitable for most investors as they are speculative and involve a high degree risk, including risk of loss of capital. There is no assurance that any implied or stated objectives will be met. Osmosis has based the information obtained from sources it believes to be reliable, but which have not been independently verified. Osmosis is under no obligation and gives no undertaking to keep the information up to date. No representation or warranty, express or implied, is or will be made, and no responsibility or liability is or will be accepted by Osmosis, or by any of its officers, employees, or agents, in relation to the accuracy or completeness of the information. No current or prospective client should assume that future performance will be profitable the performance of a specific client’s account may vary substantially due to variances in fees, differing client investment objectives and/or risk tolerance and market fluctuations.