Environmental boutique, Osmosis Investment Management, soars through $10 billion AUM milestone as major asset owners opt for an evidence-based approach.

The London-based asset manager has bucked a trend of industry outflows, tripling its assets under management over the year.

Dedicated to the ‘E’ of ESG since 2009

Osmosis, founded in 2009, on an idea, with no product, no assets, and just four employees, has grown to a team of thirty-five dedicated specialists headquartered in London with expansion underway in North America. Major institutions from Australia, North America, Europe, and the UK have allocated capital to Osmosis as the firm seeks to target better risk-adjusted returns while reducing the environmental impact of their equity portfolios through the reduction in ownership of Carbon Water and Waste relative to both custom and mainstream benchmarks. Recent additions to the client roster include Cambridgeshire and Northamptonshire LGPS, Dutch State Pension Fund PGB, and Danish Pension Fund PKA.

The firm, which was awarded Boutique Manager of the Year 2022*, attributes its success to its proprietary research approach, a deep understanding of managing environmental risk in portfolio construction, its significant environmental savings, and its cost-effective and responsible approach, which is reflected in the firm’s philosophy that to shift capital at scale, sustainable investing should not come at the cost of investment returns. Osmosis was recently found to be the most competitive fund in a pool of 80 global active equity funds by ClearGlass Analytics**

*The Environmental Finance Sustainable Investment Awards are free to applicants and open to all organisations globally. These awards were given in June 2021 and June 2022 and relate to the annual period May 20-May 21 and May 21-22. Environmental Finance independently provided Osmosis with a questionnaire to be used in the preparation of the third-party rating or award.

**ClearGlass collected and compared data from 80 asset managers in Active Equity or Active ESG Equity Funds, for the annual period 2022. Osmosis received the Outcome Variance Analytics in April 2023. Osmosis did not pay to be included in the group of asset managers ClearGlass reviewed, however, Osmosis provided compensation to ClearGlass to obtain the Outcome Variance Analytics and report.

Ben Dear, CEO, Osmosis Investment Management

Hitting the $10 billion milestone is an incredible achievement for the firm. When we launched in 2009, we had high ambitions but recognised that bringing a new idea, driven by a new data set, under a new brand would be met with some caution by the market. We accepted that we would be judged by the outcomes of our investment strategies but reasoned that sustainable investing was a long-term trend and that we would have to be committed to the long haul. Time was literally on our side.

We have weathered extreme bouts of volatility driven by political insanity, a global pandemic and war in Europe only to see the business emerge stronger. We are now supported by a growing global cohort of sophisticated investors. We are thankful to our ever-supportive shareholders and our committed team, who have believed in our mission from day one and continue to believe that we have much further to go. Personally, as our assets continue to grow, I look forward to the company having a louder voice in the industry to help drive the change that is required, both from our industry peers and the companies in whom we invest, and to raise awareness of the economic opportunities and challenges associated with transitioning to a more sustainable world economy.

Financial and Environmental Performance

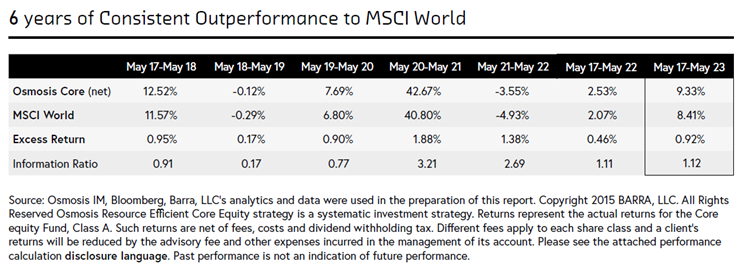

The firm’s flagship Core Equity Strategy was awarded Environmental Fund of the Year in 2021 and Global Equity Fund of the Year in 2023* and is, on average, 65% less resource intensive than the MSCI World Index. The UCITS Fund*** recently celebrated its 6th consecutive year of outperformance against the MSCI World Index (31 May 23), re-enforcing the firm’s core philosophy that targeting better risk-adjusted returns and measurable environmental impact need not be mutually exclusive.

*The Environmental Finance Sustainable Investment Awards are free to applicants and open to all organisations globally. These awards were given in June 2021 and June 2022 and relate to the annual period May 20-May 21 and May 21-22. Environmental Finance independently provided Osmosis with a questionnaire to be used in the preparation of the third-party rating or award.

*** The Core equity fund is not available to US investors. Separate accounts are available for US investors using the same model and investment objective.

The strategy has attracted over $9 billion into a pooled UCITS vehicle (OMWSBAU) and a suite of customised segregated accounts from some of the world’s largest institutional asset owners as they seek to mitigate long-term environmental risks while balancing fiduciary duty.

Resource Efficiency as an Investment Signal

Osmosis employs a quantitative approach that, through a dedicated in-house research function, analyses corporate carbon, water, and waste data going back to 2005. The firm’s models have demonstrated that those companies that, on a sector-relative basis, better manage their resources relative to the economic value they create are likely to outperform their peers in the long term. The research program has been further backed up by independent academic research.

As broad ESG approaches and providers come under increasing scrutiny for the subjectivity of their scoring methodology, the Osmosis approach, which measures a company’s sustainable action rather than its intentions, has continued to gain momentum. As evidenced during last year’s market downturn, unintended portfolio outcomes (many driven by over-reliance on external ESG data vendors), can leave investors exposed to significant underperformance.

The independent nature of Resource Efficiency as an investment signal has allowed the firm to build investment strategies within risk-controlled frameworks accounting for the common country, industry, and factor biases.

Important Information

This document is issued by Osmosis (Holdings) Limited, a London-based investment management group. Osmosis Investment Management UK Ltd (“OIM UK”) is an affiliate of Osmosis Investment Management US LLC (“OIM US”). Osmosis Investment Management AUM includes discretionary assets under management of OIM US and OIM UK and assets invested in model programs provided by OIM US and OIM UK.

NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. The Osmosis Resource Efficient Core Equity Fund is not available for U.S. Investors. A Client’s account will be managed by Osmosis based on the strategy, but the actual composition and performance of the account may differ from the Fund due to differences in the timing and prices of trades, and the identity and weightings of securities holdings.

Performance

Net Performance. Net returns are net of fees and in USD unless indicated otherwise. Net returns are net of fees, costs and dividend withholding tax. Different fees may apply to a client’s account and a client’s returns may be further reduced by the advisory fee and other expenses incurred in the management of its account. Please see the specific performance disclosure under each table for additional details.

***Returns represent the actual returns for the Osmosis Resource Efficient Core Equity Fund, Class A. Net returns are calculated by subtracting the following expenses: actual transaction costs incurred, investment management fees of 0.10%, accruals for professional, administration and custodian fees (TER is 0.21%) and dividend withholding tax. Different fees apply to each share class and a client’s returns will be reduced by the advisory fee and other expenses incurred in the management of its account. Please see the attached performance calculation disclosure language. Past performance is not an indication of future performance.

Benchmarks

The historical index performance results for all benchmark indexes do not reflect the deduction of transaction, custodial, or management fees, the incurrence of which would have the effect of decreasing indicated historical performance results. Indexes are unmanaged and are not available for direct investment. The historical performance results for all indices are provided exclusively for comparison purposes only and may or may not be an appropriate measure to provide general comparative information to assist an individual client or prospective client in determining whether Osmosis performance meets, or continues to meet, his/her investment objective(s). The referenced benchmarks may or may not be appropriate benchmarks against which an observer should compare our returns.

The MSCI World Index captures large and midcap representation across 23 Developed Markets countries. With 1,645 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.