By Alienor Hammer

As a result of Russia’s invasion of Ukraine – the global energy transition we had hoped for is simply not happening.

Inter-related energy and cost of living crises now dominate political agendas, and securing near-term energy supplies has become a number one priority. Meanwhile, as price pressures mount on households and businesses, governments need to offer rapid assistance without destabilising public finances and investor confidence.

These are testing times for global leaders, many of whom have committed to a timely reduction of our dependency on imported fossil fuels. This article explores the current short-term solutions and asks what they mean for long-term climate mitigation and the journey to a just transition.

Expanding Fossil Fuel Infrastructure

Perhaps the most publicised example of recent government mitigation measures with a negative environmental outcome is the recommissioning of many ‘ready-to-be-decommissioned’ power plants, which have had their life extended due to energy security concerns. In Germany, RWE’s Neurath D and E coal power plants have had their decommissioning dates pushed back from the end of 2022 to the beginning of 2024 [1], leading to an increase in carbon emissions from one of the EU’s most carbon-intensive power plants [2]. Similarly, in the UK, the government is temporarily relaxing permitting conditions for coal-fired power plants for the coming winter [3]. France, facing problems with its nuclear fleet, has joined the list of companies considering bringing retired coal-fired power plants back online.[4]

These plans are happening in the face of a plethora of reports from the IPCC and other climate-focused bodies that highlight that the current and future CO2 emitted from all existing fossil fuel infrastructure on Earth already exceeds our carbon budget. Decommissioning should be accelerated rather than pushed back[5].

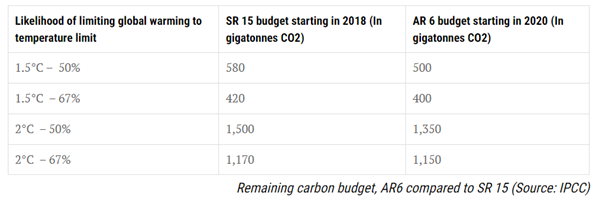

The first instalment of the Sixth Assessment Report (AR6) by the Intergovernmental Panel on Climate Change, released on August 9, 2021, has provided an updated estimate of the carbon budget — the maximum amount of carbon dioxide (CO2) that can be emitted while still having a chance to limit warming to 1.5°C or 2°C.

Energy Bill Relief

A more subtle but no less damaging mitigation measure lies in government relief schemes. Following high inflation and surging energy prices, the UK rolled out its Energy Bill Relief Scheme to help businesses and other organisations, setting prices at £211/MWh for electricity and £75/MWh for gas, compared to wholesale costs at £600/MWh for electricity and £180/MWh for gas[6]. These subsidies will dampen the penalties for inefficient companies and limit the rewards for efficient companies—an unintended and costly consequence at a time when the planet can’t afford any further delays.

High Energy Prices should Help, not Hinder

Rocketing energy prices should be causing a massive drive towards energy efficiency. After all, the cheapest energy is the energy you don’t use. Additionally, the business case for transitioning faster towards renewable energy becomes stronger with every day the war continues. Higher fossil fuel prices should lead to a transition towards cheaper, renewable energy. Instead, governments are prioritising existing fossil fuel assets, further locking businesses into using these carbon-intensive fuels and hindering the efficiency of market forces from doing their work.

Time is running out

“Any further delay in concerted anticipatory global action on adaptation and mitigation will miss a brief and rapidly closing window of opportunity to secure a liveable and sustainable future for all.”

IPCC Climate Change report 2022

As we argued in a previous paper, a time value is attached to emission reductions. While significant reductions in carbon emissions are of utmost importance, the reduction path governments and companies take to reach this goal is arguably more so. As an industry, we must remember that due to the cumulative effect, a tonne of carbon reduced today has more environmental value than a tonne of carbon reduced tomorrow or next year. We cannot afford to postpone or delay large programs driving energy efficiency or lose focus of the need to reduce our carbon emissions as aggressively as possible.

Above all, the current energy crises highlight that energy efficiency is not only an environmental must but also an economic must. While we fully support government action to shield the most vulnerable and support them through this crisis, policies should be designed to harness the economic pull towards efficiency while supporting those in need. Subsidising fossil fuels or opening coal-fired power plants might have short-term gains but will hinder our long-term goals drastically.

[1] Agreement on coal phase-out 2030 and strengthening security of supply in the energy crisis (rwe.com)

[2] Biggest carbon polluters in the EU 2021 | Statista

4 https://www.france24.com/en/live-news/20220626-ukraine-war-pushes-france-to-rethink-coal-power-station-closure

[6] Energy Bill Relief Scheme: help for businesses and other non-domestic customers – GOV.UK (www.gov.uk)