Quick Read

- Commodity price rises continue to shock the economy. The effects won’t be uniform.

- Waste efficiency has never been so important to a corporate’s bottom line.

- Waste efficiency can also be a source of alpha in portfolios.

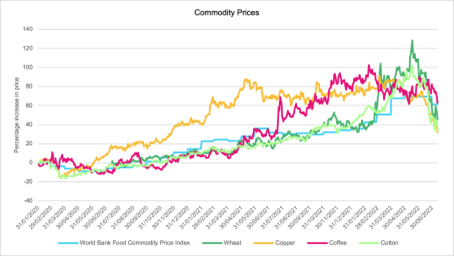

Commodity prices have been running rampant for a while now. Fuelled by the war in Ukraine and pandemic supply chain disruptions, everything from oil to wheat and coffee has fallen prey to extraordinary inflationary price rises. Indermit Gill, the World Bank’s vice president for Equitable Growth, Finance, and Institutions said that “this amounts to the largest commodity shock we’ve experienced since the 1970s”[1].

Figure 1: A chart showing the percentage increase in commodity prices. Source: Bloomberg

There is little doubt that this commodity shock will continue to impact the entire economy, and our research demonstrates that it won’t be felt uniformly across companies. As commodity prices increase, so does the importance of using them wisely.

At Osmosis our long-standing belief is in companies that can create more economic value while doing less environmental harm; the efficient utilisation of materials is key to our investment thesis. If companies are as efficient as possible with the resources they use, they not only minimise their waste output – but also improve their financial performance and simultaneously reduce their environmental impact[2]. In times of commodity price rises, minimising waste is important but, even more so is a company’s waste production relative to their economic value creation. If a company can create a given product using fewer resources and producing less waste than their peers, they will need to purchase a smaller quantity of commodities. A 26% increase in the price of iron ore, as we have seen in the year to date[3], is clearly a larger issue for companies wasting iron than companies that can create value with all of the iron they have purchased. Commodity price rises will increase the cost of goods sold more for inefficient companies than efficient, leaving efficient companies with better margins and inefficient companies with increasingly valuable unutilised waste streams.

A report from Bank of America found that “the raw material cost in an average U.S. vehicle has been steadily rising, increasing ~87% from a low point of approximately $2,200/unit in Apr ’20 to now roughly $4,125/unit in May ’21”[4]. With the global automotive steel market valued at just over $100 bn[5], a 26% increase in the price of iron ore is clearly a massive expense for the automotive industry, however, automotive manufacturers will be hit less hard if they are more efficient with their use of commodities.

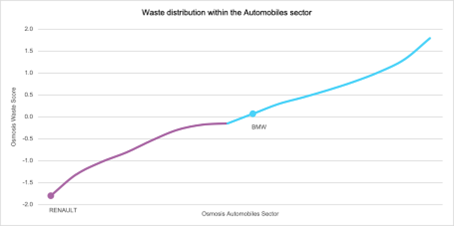

For example, according to the Osmosis Model of Resource Efficiency (MoRE), Renault uses its materials effectively in comparison to other automobile producers. In 2020 the company produced around 230kg of waste per vehicle sold. By comparison BMW produced 45% more, at 330kg[6]. The impact of this 100kg difference will be directly influenced both by the material mix and the cost of the materials. An increase in the price of any wasted materials will be felt 26% more strongly by Renault than by BMW, making Renault more exposed to volatility in commodity prices.

Figure 2: A chart showing the waste distribution within the Automobiles sector. Source: Osmosis IM. Data as of July 22.

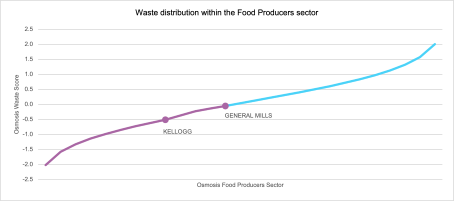

The importance of using materials wisely is not isolated to manufacturers. Commodity price increases have been felt across the entire economy. The World Bank’s Food Commodity Price Index is up more than 60% over the last two years[7], having far-reaching impacts on consumers and food producers. The price of coffee has increased by 72%, corn by 42% and cotton by 40% (down from highs in mid-2022 of 100%, 89%, and 101% respectively[8]). Comparing two multinational food producers with similar product mixes, our model shows that Kellogg produces 17% more waste per unit of revenue than General Mills[9]. By producing 17% more waste, Kellogg will feel these soft commodity price increases 17% more strongly, directly and significantly negatively impacting their bottom line.

Figure 3: A graph showing the waste distribution within the Food Producers sector. Source Osmosis IM. Data as of July 2022.

Through the standardisation of unstructured environmental data, our in-house research process gives context and comparability to corporate environmental disclosures by objectively comparing the environmental balance sheets of companies across 34 industry sectors. Our evidence-based approach, through the stripping out of subjective data, measures sustainable action over intent.

The Osmosis Model of Resource Efficiency (MoRE) covers both the demand-side and the supply-side of the economy. On the demand-side it indicates downstream companies that are using the available commodities most efficiently, manifesting in reduced commodity demand for the same level of output as an inefficient company. Looking at the supply-side, the MoRE demonstrates which commodity producers can produce and sell a unit of the commodity while wasting less. This process results in companies with more efficient production processes being rated more highly than companies that are not able to extract as much of the commodity. If two mining companies extract iron ore but one can extract it more efficiently and end up producing half the volume of waste per kg of iron ore, then the efficient company will be promoted in the model.

In a recent engagement, the Australian iron ore producer Fortescue stated ‘The average realised price of iron ore was US$79/wmt in FY20, rising to US$135/wmt in FY21. This factor accounts for the majority of our increase in revenue, with no significant change to the nature of our operations, ore production, emissions, or our waste production’[10]. When commodity prices increase, efficient supply-side companies will receive more of the upside, and efficient demand-side companies will have a smaller increase in their cost of goods sold compared to their inefficient peers.

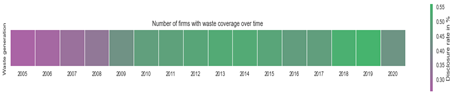

While the price of commodities is one of the levers prompting companies to be more efficient with their use of resources, it is not the only factor. Another factor is the cost of waste disposal and, while this is not considered material for the public disposing of personal waste, the same cannot be said for companies. Since our models began, Osmosis has witnessed a significant increase in waste disclosure within the MSCI World. Crucially, these disclosure improvements have been seen across the whole economy with ‘higher’ waste impact sectors increasing their disclosure in line with (and often better than) the rate of ‘lower’ waste impact sectors, improving the efficacy of the MoRE over time across sectors and geographies.

Figure 4: A graph showing the waste disclosure levels in the MSCI World index. Source: Osmosis IM

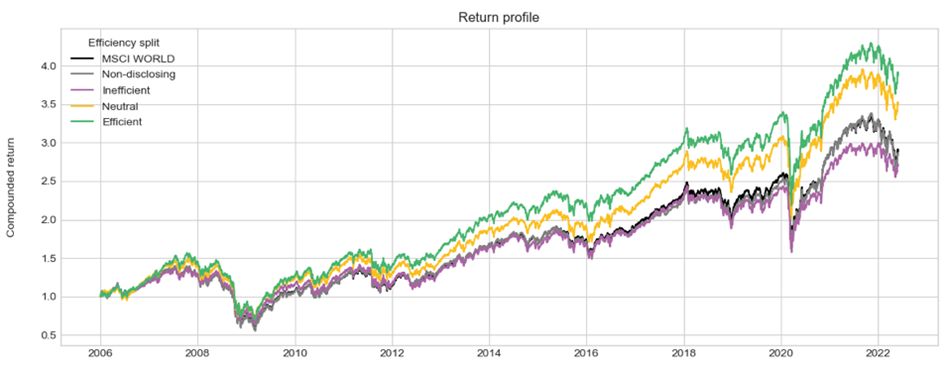

All companies that we evaluate within our Model will be given a Resource Efficiency (RE) score with which we can then accurately compare the environmental impact of companies to their value creation. Along with carbon emissions and water consumption, a corporate’s waste generation is one of the underlying factors used to create this score. A company with more efficient operational processes will create less waste and have to purchase fewer materials which we believe, and our models have demonstrated, could lead to outperformance in the long run, especially in an environment with high commodity prices. We have witnessed outperformance from waste efficient companies 13 out of the last 17 years[11] and the compounded return of a long waste efficient and short waste inefficient portfolio is shown on the graph below where we see significant outperformance of efficient companies. Not only is operational efficiency beneficial for the environment, but it may also be a source of alpha.

Figure 5: A graph to show the compounded long – short return of waste efficient – waste inefficient companies from 2006 to present. Source: Osmosis IM

We analysed gross compounded returns with dividends reinvested of companies in the MSCI World during the time period from 31/12/2005 to 31/05/2022. This graph shows the return profiles of companies that are split into four groups: the most Waste Efficient companies (top third in green), the least Waste Efficient companies (bottom third in purple), the neutral companies (middle third in yellow), and the non-disclosing companies (grey) for which we have inadequate waste generation data. We also show the performance of the MSCI World Index. All portfolios are equal weighted with sector weights forced to be proportional to the benchmark. Source: Osmosis IM, Bloomberg, S&P. Data as at end May 2022. Past performance is not an indication of future performance.

Important Information

This document was prepared and issued by Osmosis Investment Research Solutions Limited (“OIRS”). OIRS is an affiliate of Osmosis Investment Management US LLC (regulated in the US by the SEC) and Osmosis Investment Management UK Limited

(regulated in the UK by the FCA). OIRS and these affiliated companies are wholly owned by Osmosis (Holdings) Limited (“Osmosis”), a UK based financial services group. Osmosis has been operating its Model of Resource Efficiency since 2011.

The examples of specific investments described herein should not be considered a recommendation to buy or sell any specific securities. There can be no assurance that such investments will be purchased in a client’s portfolio. It should not be assumed that any of the investments identified in these case studies will be profitable in the future.

Whilst the information contained herein is believed to be accurate, no representation or warranty, express or implied, is or will be made, and no responsibility or liability is or will be accepted by Osmosis, or by any of its officers, employees or agents, in relation to the accuracy or completeness of this document or of any information contained within it.

Osmosis ©2022

[1] Osmosis

[2] Osmosis engagement with Fortescue Metals Group LTD as of 16/06/2022

[3] Bloomberg

[4] Bloomberg

[5] Osmosis Analysis with all underlying data taken from Corporate Sustainability Reports

[6] https://uk.finance.yahoo.com/news/raw-material-costs-rising-for-automotive-industry-bof-a-report-172812315.html

[7] https://www.grandviewresearch.com/industry-analysis/automotive-steel-market#:~:text=The%20global%20automotive%20steel%20market, 3.2%25%20from%202019%20to%202025.

[8] Osmosis Analysis with underlying data sourced from Corporate Sustainability Reports

[9] https://www.osmosisim.com/uploads/2021/01/fa92b6a95bdb33d45550161d53e24fd9/resource-efficiency-firm-value.pdf

[10] Bloomberg as of 06/07/2022

[11] https://www.worldbank.org/en/news/press-release/2022/04/26/food-and-energy-price-shocks-from-ukraine-war