Executive Summary

The Osmosis Core Equity Fund has officially reached its 5th anniversary. A significant milestone for the Fund which targets better risk-adjusted returns whilst significantly reducing the environmental ownership of carbon, water and waste relative to the benchmark.

While the objective may sound simple, as evidenced by the plethora of products flooding the market with such ambitions, achieving these goals is both challenging and highly complex. Complexity which has been compounded by the underlying market environment. For the Fund to achieve its goals while replicating the style and common factor risk exposures of the benchmark has demonstrated that sustainability, when measured objectively through the lens of resource efficiency, has been rewarded by the market.

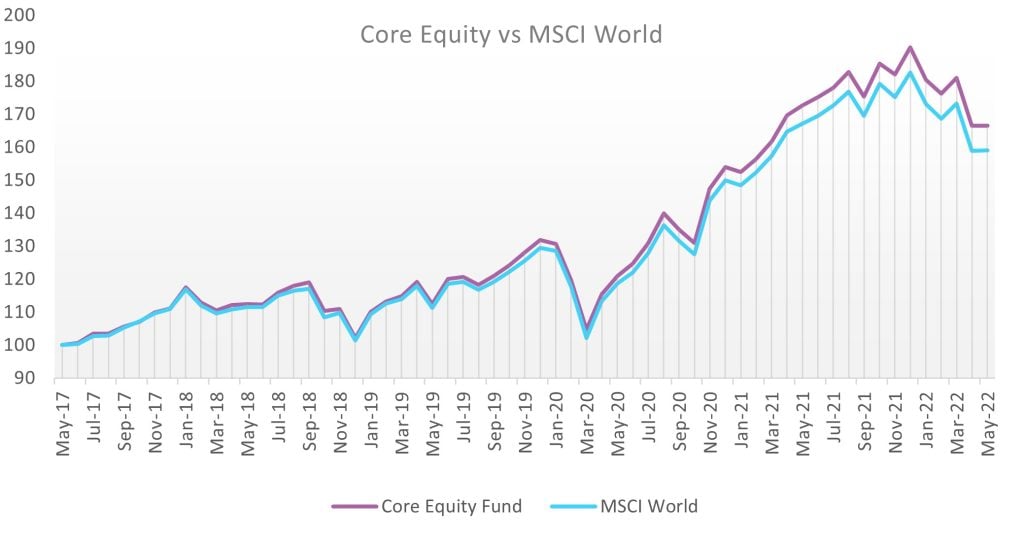

Figure 1. Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved Osmosis Resource Efficient Core Equity strategy is a systematic investment strategy. Returns represent the actual returns for the Core equity Fund, Class A. Such returns are net of fees, costs and dividend withholding tax. Different fees apply to each share class and a client’s returns will be reduced by the advisory fee and other expenses incurred in the management of its account. Please see the attached performance calculation disclosure language. Past performance is not an indication of future performance.

Ultimately, we remain convinced that investors can mitigate environmental risk and drive financial returns whilst controlling active risks to the traditional benchmark. We continue to labour the point that investing sustainably need not come at the cost of financial return.

A long-term sustainable investment strategy sits uncomfortably in the world of short-term performance reporting. Reviewing the portfolio over a 5-year time frame, albeit with monetary intervention all but driving the cycle, is a good point to appraise the Fund against its stated objectives.

A consistent record of outperformance

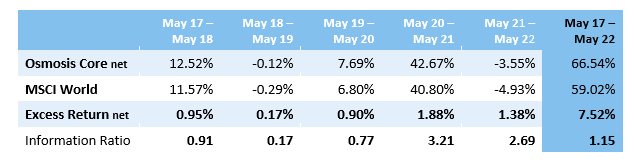

Figure 2.

Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved Osmosis Resource Efficient Core Equity strategy is a systematic investment strategy. Returns represent the actual returns for the Core equity Fund, Class A. Such returns are net of fees, costs and dividend withholding tax. Different fees apply to each share class and a client’s returns will be reduced by the advisory fee and other expenses incurred in the management of its account. Please see the attached performance calculation disclosure language. Past performance is not an indication of future performance.

We are very proud to report that since its inception, the Fund has delivered on its financial and environmental objectives showing consistent outperformance to its benchmark, delivering an information ratio of 1.15 and average environmental savings of 62% of carbon, 68% of water and 63% of waste.

For full article please download.