Price spikes put renewed focus on construction waste

The resource-intensive sector’s approach to waste management has never been more important, says Benjamín Stimpson

Over the last ten years, companies in the construction sector have not had to pay much more for their materials – concrete, timber, bricks, and the like – than they did before 20101.

In February 2020 that all changed as the coronavirus pandemic wreaked havoc with the sector’s supply chains. Prices of materials have spiked some 20% to date, with little sign of the trend reversing until at least mid-20222.

The construction sector is notorious for its negative environmental impacts. By some estimates, civil works and building construction activities consume 60% of the raw materials extracted from the lithosphere3.

As these issues have driven up concerns over the economic and environmental sustainability of the sector, attention has been drawn to a problem at which these issues intersect: the massive output of waste by the sector. According to the UK’s DEFRA, for example, the sector produced 62% of the nation’s total waste output in 20184.

From a profitability perspective the sector’s waste management has never been more important.

At Osmosis, we have always maintained that the solution to both the economic and environmental problem of waste lies in a single idea: Resource Efficiency.

If companies are as efficient as possible with the resources they use, they not only minimise their waste output – but also improve their financial performance and simultaneously reduce their environmental impact.

“In other words, recycling is not the eco-efficiency win-win that many assume it to be. It does not lead to the economic benefits that waste prevention and reuse will, it simply kicks the can down the road”

The idea is not a new one. In 1995 Harvard Business School’s Michael E. Porter and Claas van der Linde, of St Gallen, argued that there were ‘eco-efficiency’ win-wins available to many companies, using waste reduction as a key example5.

Really, the idea is older still – relating directly to the heart of economics itself. As anyone who has taken an introductory economics class will tell you, the field of economics is defined by the problem of managing scarce resources.

Success in a competitive market for these scarce resources is a direct consequence of how efficiently those scarce resources are utilised.

So, how do companies in the construction sector go about managing their waste? We looked at some of the companies in our portfolio to find out.

Waste prevention

At the higher levels of the waste management hierarchy, preventing materials becoming waste is of interest to many of our companies. For example, Taisei6, one of Japan’s leading general contractors, is using innovations in ICT technologies to manage sites more efficiently, cutting down wasted or unused material.

Similarly, Shimizu7, another of Japan’s construction giants, innovated by precutting important pieces of materials in factory, rather than on site.

Re-using materials

Lower down the hierarchy, reusing materials to extract as much value as possible was also of interest.

At VINCI8, a large French firm, innovations at this level include the reuse of worksite materials in projects, such as using excavated soil as backfill or recovering a large fraction of cement from the jet-grouting process.

While Lendlease9, an Australian firm, reuses waste glass in road base.

Indeed, VINCI has further moved to reuse mature materials collected in their demolition projects, creating a marketplace for other contractors – turning waste into a new product.

Recycling

Lower still, and perhaps most popular amongst firms (at least from their own reports), is engagement with recycling. Many firms report targets for the fraction of waste that is recycled.

The Swiss firm Holcim10, takes it a step further and sells on their recycled waste to the many companies (including many of Osmosis’ portfolio firms) that seek to reduce their environmental impact by using a greater fraction of recycled inputs.

So, when it comes to efficiency, are each of these approaches to waste equal? We argue that they are not.

When considered in the context of a drive to ‘do more with less’ (the heart of resource efficiency), recycling is not an efficiency improving process at company level – unlike waste prevention or reuse.

Whether waste ends up recycled or in landfill says nothing about how much value has been extracted while the materials were within the firm’s control.

In other words, recycling is not the eco-efficiency win-win that many assume it to be. It does not lead to the economic benefits that waste prevention and reuse will, it simply kicks the can down the road: relying on other companies to produce the required recycled products from raw materials.

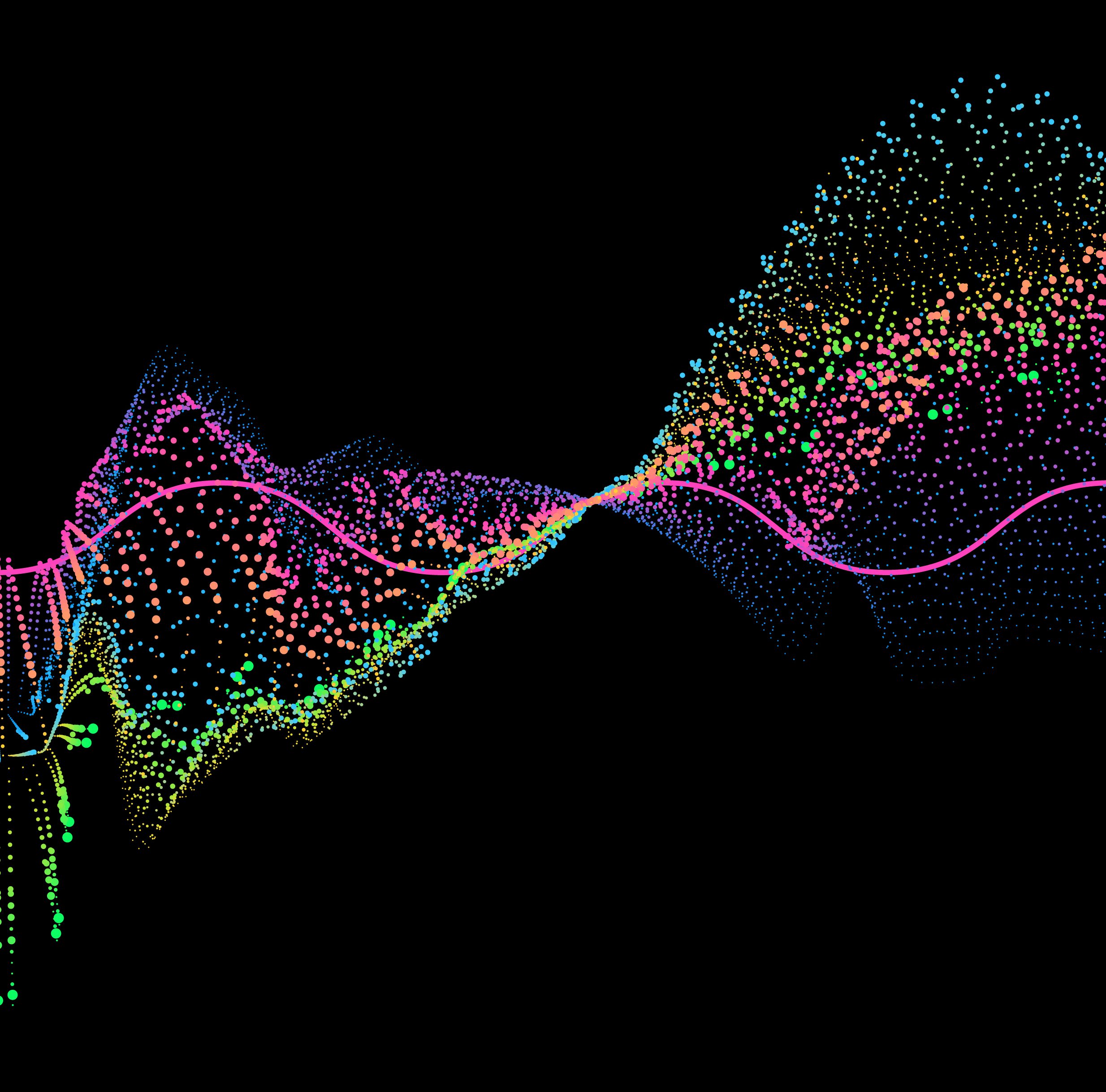

Osmosis’ Model of Resource Efficiency demonstrates the economic potential of truly engaging with waste through prevention and reuse. In the figure below, the most waste-efficient companies strongly outperformed both neutral and inefficient companies – while posting significant waste reduction. Recycling is never brought onto our environmental balance sheets.

So, what is our message to companies within the construction sector?

- Start looking at waste management as the economic opportunity that it is

- Do not treat recycling as the sole answer to your waste problems

- Engage strongly with waste prevention and reuse processes

- Support the creation of a circular sector – opening a pathway to long term economic and environmental sustainability.

Benjamín Stimpson is environmental researcher at Osmosis Investment Management.

Bibliography:

1 https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1013741/21-cs9_-_Construction_Building_Materials_-_Commentary_August_2021.pdf

2 https://think.ing.com/articles/some-building-material-prices-remain-high-till-at-least-mid-2022

3 Habert, G., Arribe, D., Dehove, T., Espinasse, L. and Le Roy, R., 2012. Reducing environmental impact by increasing the strength of concrete: quantification of the improvement to concrete bridges. Journal of cleaner production, 35, pp.250-262.

4 https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1002246/UK_stats_on_waste_statistical_notice_July2021_accessible_FINAL.pdf

5 Porter, M.E. and Van der Linde, C., 1995. Toward a new conception of the environment-competitiveness relationship. Journal of economic perspectives, 9(4), pp.97-118. Available here: https://www.jstor.org/stable/2138392

6 https://www.taisei.co.jp/english/csr/library/pdf/2020/corp2020_main_a3.pdf

7 https://www.shimz.co.jp/en/company/csr/environment/performance/recycle/

8 https://www.vinci.com/publi/vinci/extract/2020_workforce_related_environmental_and_social_information.pdf

9 https://www.lendlease.com/-/media/llcom/investor-relations/asx-announcements/2020/2020-annual-report.pdf

10 https://www.holcim.com/sites/holcim/files/atoms/files/26022021-finance-lafageholcim_fy_2020_report-en.pdf