By Lily Andrews, Environmental Analyst

Executive Summary

- The European Commission is concerned that Chinese green technology subsidies may be distorting markets and creating unfair competition by undercutting European competitors.

- Current anti-subsidy investigations are targeting Chinese green technology products, as the EU’s Net Zero Industry Act aims to reduce dependence on China and promote domestic production.

- As investigations cover crucial green products like Electric Vehicles and solar panels, it has raised concerns that the EU may not be able to achieve its ambitious transition goals without affordable Chinese technology.

Potential for more harm than good

The European Union is beginning investigations into Chinese-made solar panels and electric vehicle (EV) parts which it contends could be significantly cheaper than market value due to extensive government subsidies. But is it potentially harming itself in the process?

Anti subsidy investigations, whilst aimed to ensure fair competition, may not be the answer to achieving the EU’s net zero emissions targets. On the contrary, the latest probes into Chinese green technology subsidies have sparked fears that they could hinder, rather than aid the EU’s transition to a more sustainable economy.

The issue of unfair competition

The European Commission argues that Chinese green technology subsidies distort markets and allow firms to undercut European competitors by lowering production costs, resulting in what it describes as “unfair competition”1 .

To address this issue, electric vehicle and solar panel subsidies are being investigated as part of the new EU Net Zero Industry Act which aims to reduce dependence on China and strives for at least 40% of green technology used in the EU to be domestically produced by 2030[i].

If investigations deem excessive subsidies exist, anti-subsidy measures are likely to be employed, which would typically include adding a percentage of the price to goods, imposing a fixed amount per unit, setting a minimum import price, or implementing price undertakings, where exporters commit to selling products at minimum prices to avoid duties2. Whilst these mechanisms would be implemented to bolster domestic production of products crucial to the low-carbon transition, they may limit the EU’s ability to achieve its ambitious Net Zero plans if access to affordable Chinese green technology is curtailed.

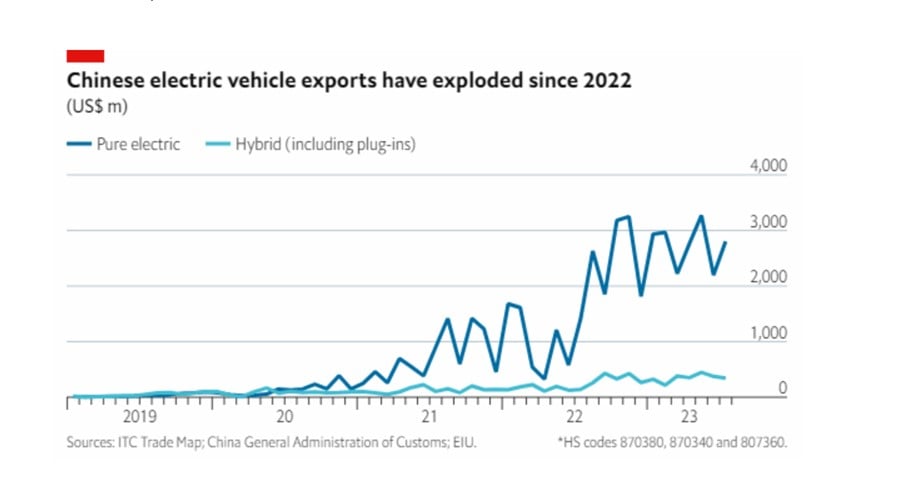

Scrutinising EV imports

European Commission President Ursula von der Leyen announced the EV subsidy investigation in October 2023, emphasising Europe’s openness to competition while underscoring the need to address market distortions caused by potential green technology subsidies3 . The volume of subsidies under review is significant, with Reuters noting that Chinese state subsidies for electric and hybrid vehicles amounted to $57 billion from 2016- 2022 4. The investigation will scrutinise whether EV imports from China are subsidised by the Chinese government, whether the supposed subsidies are causing harm to the EU’s EV sector, and if imposing countervailing measures would be in the EU’s interest5 . The scope of the investigation is also relatively wide, covering non-Chinese EV brands manufactured in China, such as Tesla. The investigation is ongoing and set to be completed by late 2024. The focus on China is notable, given that Biden’s Inflation Reduction Act, which has directed $369 billion towards EV cars and clean energy, has been criticised but not investigated by the EU67 . Furthermore, the EU investigation was publicly backed by US trade representatives in September 2023 as a means to “defend the space to have fair and free trade”8 .

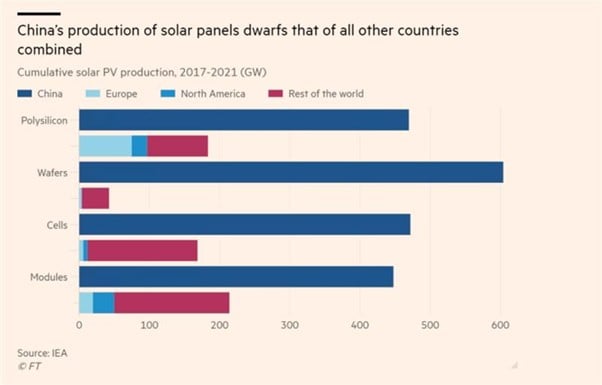

A dependence on cheap solar panels

Similarly, as of February 2024, the European Commission began preliminary talks on measures to support failing EU solar manufacturers through anti-subsidy mechanisms, again focused on Chinese manufacturing9 . This is particularly significant given that China is a critical supplier in Europe’s green transition, with statistics from the International Energy Agency’s database revealing that the majority of solar panels and related parts in 2023 originated from China 10. Furthermore, 2023 saw a record number of European solar energy installations, up 40% compared to 2022, which can be largely attributed to the affordability of these Chinese solar panels11 . Despite these products being a crucial factor in Europe’s accelerating solar energy deployment, in January 2024 European solar manufacturers called on the European Commission to act against China’s solar panel parts in an open letter. This letter highlighted how challenges posed by oversupply and competitive pricing from China have severely impacted their business models12 . This is not the first time Europe’s dependence on cheap Chinese solar panels has been called into question: in 2013, the European Commission found that Chinese solar panels in Europe were significantly underpriced, and anti-subsidy measures were applied subsequently 13. Whilst current solar panel anti-subsidy talks are in preliminary stages, legislative initiatives have been introduced that seek to expedite and simplify permits for local manufacturing of EU industrial transition products, including solar panels, under the EU Net-Zero Industry Act14 .

An invitation for criticism

Unsurprisingly, the potential for legislation against green technology subsidies is not without stark criticism. In pursuit of becoming the first continent to reach Net Zero 15, the EU aims to elevate solar power to its primary energy source by 2030, necessitating a three-fold increase in solar power generation. The bloc also plans to ban the sale of new carbon-emitting cars in Europe by 2035, under the ‘Fit for 55’ deal 16. Doubts are emerging about the EU’s ability to achieve its ambitious solar deployment targets without access to cheaper Chinese solar panels and achieving its ambitious vehicle electrification goals without Chinese vehicles. This raises concerns about whether the EU’s subsidy measures are overly protectionist attempts to bolster EU production and whether they might inadvertently hinder their transition efforts.

The Chinese Reaction

Further, as the anti-subsidy green technology measures predominantly target Chinese industries and entities, there are apprehensions about China’s potential reactions to this more protectionist stance. Some commentators argued that the World Trade Organization might not even classify the low cost of Chinese green technology as true subsidies17 and China’s commerce minister has voiced strong dissatisfaction over the investigations, especially those concerning China’s inexpensive EVs18 . There are suspicions that China may retaliate by filing responses with the World Trade Organization (WTO) against post-pandemic subsidies in key European sectors, which could in turn incur significant costs for EU manufacturers19 .

Moreover, should the EU proceed with these anti-subsidy probes, it is probable that China will challenge them through WTO settlement mechanisms. This likelihood is underscored by China’s recent filing of a WTO complaint against the US on the 23rd March 2024, which is also investigating Chinese EV subsidies. In this complaint, China alleged discriminatory requirements for electric vehicle subsidies, indicating a readiness to address perceived trade injustices20 . In the upcoming months it will be interesting to see how the EU’s investigation into Chinese EVs develops and whether a similar, full-scale inquiry regarding solar panels is launched.

Sources:

- https://policy.trade.ec.europa.eu/enforcement-and-protection/trade-defence/anti-subsidy-measures_en ↩︎

- https://policy.trade.ec.europa.eu/enforcement-and-protection/trade-defence/anti-subsidy-measures_en ↩︎

- https://www.euronews.com/my-europe/2023/09/13/ursula-von-der-leyen-to-deliver-state-of-the-european-union-speech ↩︎

- https://www.reuters.com/world/europe/eu-launches-anti-subsidy-investigation-into-chinese-electric-vehicles-2023-09-13/ ↩︎

- https://www.whitecase.com/insight-alert/european-commission-initiates-anti-subsidy-investigation-imports-electric-vehicles ↩︎

- https://www.france24.com/en/live-news/20240206-eu-strikes-deal-on-clean-tech-to-compete-with-china-us ↩︎

- https://www.theguardian.com/us-news/2023/aug/11/biden-climate-bill-inflation-reduction-act ↩︎

- https://www.atlanticcouncil.org/blogs/new-atlanticist/us-trade-representative-backs-eu-in-china-anti-subsidy-investigation/ ↩︎

- https://www.europarl.europa.eu/news/en/agenda/briefing/2024-02-05/12/eu-solar-industry-facing-unfair-competition-debate-with-the-commission ↩︎

- https://www.ft.com/content/009d8434-9c12-48fd-8c93-d06d0b86779e ↩︎

- https://www.reuters.com/business/energy/with-solar-industry-crisis-europe-bind-over-chinese-imports-2024-02-06/ ↩︎

- https://www.reuters.com/sustainability/climate-energy/europes-solar-panel-manufacturers-ask-eu-emergency-support-2024-01-30/ ↩︎

- https://ec.europa.eu/commission/presscorner/detail/en/MEMO_13_497 ↩︎

- https://www.consilium.europa.eu/en/press/press-releases/2024/02/06/net-zero-industry-act-council-and-parliament-strike-a-deal-to-boost-eu-s-green-industry/ ↩︎

- https://www.consilium.europa.eu/en/5-facts-eu-climate-neutrality/ ↩︎

- https://ec.europa.eu/commission/presscorner/detail/en/ip_22_6462 ↩︎

- https://news.bloomberglaw.com/international-trade/chinas-green-subsidies-are-a-mirage-david-fickling ↩︎

- https://www.reuters.com/business/autos-transportation/chinas-commerce-chief-unhappy-eus-anti-subsidy-probe-2023-09-26/#:~:text=BEIJING%2C%20Sept%2026%20(Reuters),his%20ministry%20said%20on%20Tuesday. ↩︎

- https://www.bruegel.org/first-glance/how-might-china-hit-back-over-eus-electric-vehicle-anti-subsidy-investigation ↩︎

- https://apnews.com/article/china-us-wto-electric-vehicle-subsidies-5048c991624f7be5e4800490e3b1273d ↩︎

Important Information

This document was prepared and issued by Osmosis Investment Research Solutions Limited (“OIRS”). OIRS is an affiliate of Osmosis Investment Management US LLC (regulated in the US by the SEC) and Osmosis Investment Management UK Limited (regulated in the UK by the FCA). OIRS and these affiliated companies are wholly owned by Osmosis (Holdings) Limited (“Osmosis”), a UK-based financial services group. Osmosis has been operating its Model of Resource Efficiency since 2011.

None of the company examples referred to above are intended as a recommendation to buy or sell securities.

The information is intended only for the use of eligible and qualified clients and is not intended for retail clients. The information does not constitute an offer or solicitation for the purchase or sale of any security, commodity or other investment product or investment agreement, or any other contract, agreement, or structure whatsoever. Recipients are responsible for making your own independent appraisal of and investigations into the products referred and not rely on any information as constituting investment advice. Investments like these are not suitable for most investors as they are speculative and involve a high degree risk, including risk of loss of capital. There is no assurance that any implied or stated objectives will be met. Osmosis has based the information obtained from sources it believes to be reliable, but which have not been independently verified. Osmosis is under no obligation and gives no undertaking to keep the information up to date. No representation or warranty, express or implied, is or will be made, and no responsibility or liability is or will be accepted by Osmosis, or by any of its officers, employees, or agents, in relation to the accuracy or completeness of the information. No current or prospective client should assume that future performance will be profitable the performance of a specific client’s account may vary substantially due to variances in fees, differing client investment objectives and/or risk tolerance and market fluctuations.