Engineering Intelligence: Where Software Meets Investment Analysis

What the Numbers Don’t Tell You

Investment analysis is a structured discipline, built on proven methodology , experience, and human judgment. This structure matters because much of the information that drives investment insight is verbal, not numerical. It lives in management discussions, strategic narratives, risk disclosures, and qualitative assessments – often spread across hundreds of pages.

At Osmosis NL, our analysts bring decades of investment research experience. That expertise is embedded in how we work: a systematic process for handling qualitative and quantitative information at scale. Our proprietary Sequoia system was built to support this process and is powered by the latest AI technology – not to replace how we work, but to do more of it, faster.

AI as a strategic opportunity

Bridging the gap between individual adoption and department-wide implementation of AI offers one of the greatest opportunities for asset management companies that dare to revise their business model – possibly the most significant change in the investment sector in decades.

How should financial companies implement AI?

Practical experience demonstrates that research departments in particular can benefit significantly from AI support. Crucially, AI should be deployed as a supporting instrument, not as a replacement for human judgment in the investment process.

What does future-proof technology look like?

Our strategic partnership with Bloomberg allowed us to build a sophisticated and scalable front-office infrastructure from inception, sidestepping the complexities and costs of multi-vendor system integrations.

What Analysts Actually Do

When our analysts evaluate a company, they work through financial reports, regulatory filings, and market commentary. This means pulling out relevant information, cross-referencing across documents, and checking whether different sources tell a consistent story. The process demands skill and attention, and much of it is repetitive by nature: reading, extracting, comparing, and verifying information across hundreds of pages. Doing this thoroughly for every company, every time, is difficult to sustain at scale. That’s the challenge Sequoia is designed to address.

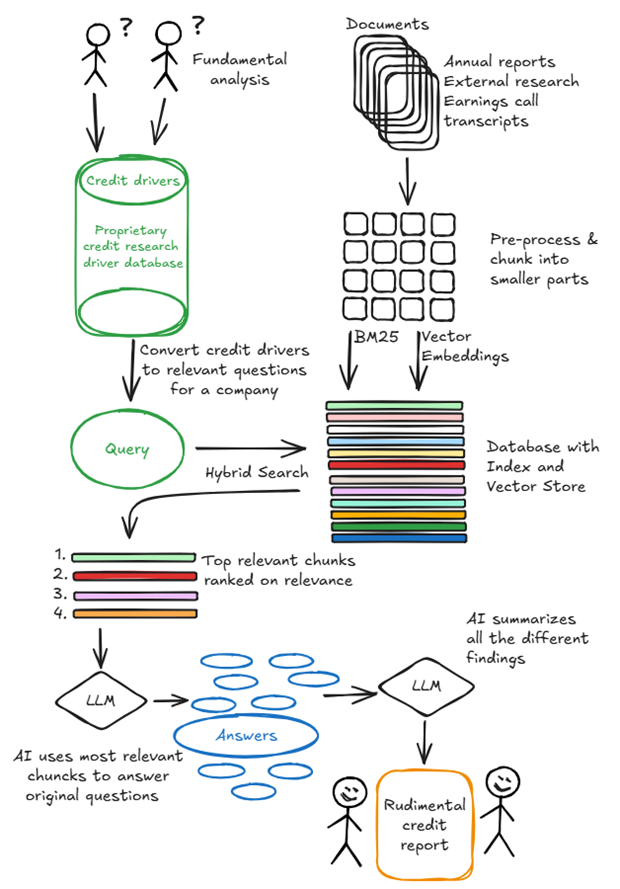

How Sequoia Works

Most AI tools are general-purpose: you ask a question and get an answer. Investment analysis doesn’t work that way, because Analysts follow a specific methodology, building from individual data points towards broader assessments while continuously checking for internal consistency.

Sequoia is built around this same structure. The system works bottom-up: specific questions about a company get analysed first, then grouped into credit driver assessments, and finally synthesised into broader thematic views. Each stage mirrors the analytical process our team members have used for years. The technology executes the heavy lifting of this workflow, while the methodology itself remains unchanged.

Making AI Accountable

For AI to be useful in professional investment work, portfolio managers need to know where insights come from. They need access to the underlying evidence, the reasoning behind assessments, and clarity on confidence levels. A system that produces insights without traceability doesn’t meet that standard.

Sequoia is designed with accountability at its core. It traces every claim back to source documents and flags uncertainty explicitly – highlighting where information is incomplete, conflicting or ambiguous. Building this level of accountability requires more engineering effort than producing outputs that just sounds plausible, but it’s essential for analysis that is defensible and reliable.

Speed Without Compromise

What used to take days of iterative review now takes minutes. Sequoia achieves this by running multiple analytical threads in parallel and then reconciling them – flagging where sources disagree and surfacing what’s most relevant to each assessment.

The speed comes from automating the most time-intensive parts of the research process, not from simplifying the analysis itself. The output follows the same methodology our analysts apply manually, covering the same dimensions and applying the same checks for consistency.

Traceability by Design

Every insight Sequoia produces links back to specific documents and page reference. This design choice reflects how investment analysis is actually being used: when presenting findings to portfolio managers or investment committees, analysts need to show their sources and defend their reasoning.

We built traceability into the system from the ground up. It is a core design principle rather than added as an afterthought.

What Comes Next

We’re extending Sequoia’s capabilities. The system will track how company narratives evolve over time, enabling trend analysis across reporting periods. It will support systematic peer comparison, and help analysts model different business scenarios (such as margin compression, revenue shocks, or changing capital structures). Each extension requires adapting the software architecture while maintaining the same standards of traceability and consistency that define our existing process. These extensions enable our analysts to conduct deeper analysis across a broader universe of companies than would be feasible manually.

Summary

Sequoia is proprietary software built around the investment research methodology we apply at Osmosis NL. It performs the heavy lifting of document analysis allowing analysts to spend more time on interpretation and judgment. The system maintains complete traceability to source documents and executes the same analytical structure our team uses manually. This enables our analysts to conduct thorough, defensible analysis at a scale and speed that manual processes cannot match.