This article was originally published in Dutch by the CFA Society. Read the article here.

Jankees Ruizeveld, Head of Research & Technology, Osmosis Investment Management NL

Victor Verberk, CEO & CIO, Osmosis Investment Management NL

Introduction

A striking paradox is currently manifesting across many organisations, including financial institutions. The vast majority of employees use Artificial Intelligence (AI) for writing emails, translating texts, or summarising documents. Simultaneously, professional environments often remain reluctant to embrace AI tools organisation-wide. A discrepancy exists between individual usage and the extent to which this is viewed as a valuable instrument for the entire organisation (Humlum & Vestergaard, 2025; Rosenbush, 2025).

This paradox has two sides. On one hand, employees readily use AI tools for personal tasks, but as soon as organisation-wide implementation is discussed, uncertainty emerges about changes to their stable work environment or even job security—their enthusiasm quickly diminishes. On the other hand, employers feel that whilst AI works for individual applications, it is not yet ready for organisation-wide processes, as structures and knowledge appear insufficient to have AI replace complex workflows. Both sides of this paradox require resolution by senior management (Lovich et al., 2025).

This article analyses how asset managers break through this paradox in practice and what concrete benefits this delivers. Practical experience demonstrates that research departments in particular can benefit significantly from AI support. Crucially, AI should be deployed as a supporting instrument, not as a replacement for human judgement in the investment process. By automating routine tasks, analysts can focus more on their core expertise and competencies, thereby actually improving the quality of analyses. This leads to efficiency gains that can translate into cost advantages for clients and new opportunities for service provision.

This practical application is illustrated through the implementation at Osmosis Investment Management NL (Osmosis NL), a boutique fixed income asset manager. This practical example demonstrates how organisations successfully translate theory into concrete results.

Jankees Ruizeveld, Head of Research & Technology, Osmosis NL (r)

Barriers from the Employee Perspective

Research shows that one in three employees hide their AI usage from their boss (Ivanti, 2025). Nearly a third do this from fear of job loss—an understandable reaction given that 52% of office workers confirm that working more efficiently only results in more tasks from their employer.

A second factor is sector-specific: the fear that compliance departments will impose restrictions on the use of AI tools. Financial professionals operate in a strictly regulated environment where data integrity, privacy, and auditable decision-making processes are of crucial importance. This often leads to AI usage remaining ‘under the radar’.

A third factor hampering the adoption of AI systems is change aversion: uncertainty about changes in a stable work environment. Investors and financial professionals are traditionally known for their loyalty to proven methodologies and working practices. Many analysts work with spreadsheet models that have stood the test of time, and Bloomberg terminals are used with screens that have sometimes remained unchanged for decades. This professional inertia, often reinforced by a relatively high average age in the sector, slows the integration of new AI capabilities into daily work practice. This preference is strengthened by a fundamental human bias: building on the familiar rather than experimenting with the unknown.

Barriers from the Employer Perspective

Asset managers operate in an environment where clients and consultants expect stability and consistency. These external parties often react cautiously to changes in working methods, even when these potentially improve service provision. Employers anticipate this conservative attitude by being careful about implementing innovations.

Additionally, risk and compliance departments express legitimate concerns about data security, privacy, and the traceability of decisions supported by AI. Without clear insight into how AI tools are specifically applied within investment processes, compliance teams tend towards a restrictive attitude. These internal control functions strive for controlled business operations, which can clash with the ‘creative destruction’ (Schumpeter, 1942) that AI innovation brings.

A third challenge concerns the transformation from individual AI usage to large-scale systems, which forms a substantial technical hurdle. Whilst individual analysts can relatively easily deploy public AI tools, organisation-wide implementation requires secure infrastructure that seamlessly integrates with business data and existing systems. Although financial institutions often possess the separate expertise, bringing this together into a coherent whole requires the right strategic choices from senior management (E. Gavrikova, Volkova & Burda, 2020).

Finally, the strategic undervaluation of IT investments within many financial institutions forms a fundamental barrier. Despite the potential of technology—and AI in particular—as a strategic growth accelerator, the IT department is often primarily treated as a cost centre where savings can be made. This is reinforced by the fact that IT costs within an asset management budget typically show the highest inflation, which naturally prompts a reaction to scale down. The result is that there is often less room for innovative projects that could add significant value in the long term. This creates, once again, a paradoxical situation: whilst budgets are tight due to declining fees, AI could deliver precisely the productivity gains the sector seeks. However, this requires vision and courage to invest in organisational change. Management teams that embrace technology alongside their traditional investment expertise likely position themselves as tomorrow’s winners.

Competitive Advantages Through AI Implementation

Practical experience shows that bridging the gap between individual adoption and department-wide implementation of AI offers one of the greatest opportunities in asset management.

Firstly, analysing companies contains numerous manual and routine activities, ranging from gathering relevant information from annual and quarterly reports to extracting financial data from reporting. Whilst this is highly skilled work requiring accounting understanding, these tasks are often very time-consuming and therefore ideally suited for automation. Practical implementation does require close cooperation between IT and investors to achieve the right outcomes.

Moreover, AI systems can effortlessly detect crucial information that is strategically hidden in footnotes or appendices. In only minutes, thousands of pages can be consulted to answer a specific question. Because each analysis uses a fixed methodology, the consistency and completeness of the research process is significantly enhanced. The result: tireless precision where human analysts inevitably fall short.

With successful implementation, increased efficiency leads to significant advantages on multiple levels. Analysts can spend more time on their core activities—in-depth analysis and judgement formation—rather than on filling in models and reading documents. More time becomes available for strategic activities such as developing well-founded and distinctive market opinions and making well-considered investment decisions. This enhances research quality, the foundation for superior alpha generation.

Additionally, this efficiency enables analysts to produce more and faster relevant analyses, build databases of previous analyses, and reach comparisons and conclusions more quickly. This efficiency drive enables asset managers to realise a dual competitive advantage: both more attractive pricing and higher quality service provision for their clients. This creates new opportunities to further develop the know-your-assets principle, enrich client reporting, offer more extensive coverage, and provide new services such as second opinions on companies that were previously beyond reach. Our practical example illustrates the scale of transformation: where an analyst traditionally needed several days for the framework of a report, the foundation for an analysis can now be established within minutes. This cost revolution transforms the fundamental economics of investment research and makes in-depth analysis economically viable on a previously unthinkable scale.

A well-implemented system stores all data and processing steps, ensuring traceability and enabling continuous refinement of analysis quality. This increases transparency of the entire investment process.

Realising these advantages, however, requires thoughtful decision-making by senior management about the organisational conditions for successful AI implementation.

Organisational Conditions for AI Success

Our practical research and resulting insights reveal that successful AI implementation requires senior management to view this technology as an enhancement of human capabilities. This so-called ‘augmented intelligence’ approach not only reduces organisational resistance but also more realistically reflects the current capabilities of AI systems. The symbiosis between human expertise and technological support leads to better results than either component could achieve separately: AI offers speed and consistency, whilst humans contribute creativity and strategic insight.

The working methods of analysts evolve fundamentally through the use of AI systems. Where they previously spent days reviewing annual reports and other relevant documents, this time-consuming reading work is now taken over by AI. The focus of analysts shifts to strategic thinking about what information is precisely needed to reach good investment conclusions. This transition still requires analysts to possess in-depth fundamental knowledge to define the right questions. Senior management must actively manage expectations about this change of focus and consistently emphasise that judgement formation remains the exclusive domain of analysts.

Successful AI implementation is only possible within a well-structured investment process. This structure ensures clear ordering of data, logic, and workflows that enables scalable, repeatable, and transparent financial analysis. For an effective process, it is essential that all analysts work according to consistent methodologies, with standardised procedures that seamlessly connect with supporting systems. Management must therefore, if not already the case, standardise the investment process as much as possible and ensure consistent application.

An underestimated advantage of structured AI implementation is enhanced control capability. Because all data can be stored in a secure environment according to predetermined structures, this facilitates future retrospective analyses to examine behavioural biases within the investment department, enabling further optimisation of the investment process. Consider detecting systematic caution among credit analysts, recognising confirmation bias where analysts unconsciously select information that confirms their prejudices, or identifying anchoring effects where previous conclusions are held too firmly. Moreover, all process steps can be audited, with the distinction between machine and human-driven components made completely transparent. Leaders must establish the right infrastructure and processes to actually utilise these enhanced control and audit capabilities.

Besides technical aspects, successful implementation also requires organisational adjustments. Crucial cooperation must emerge between investors, data scientists, and software developers. These professionals with AI affinity and programming skills must work in close proximity to enable effective cross-fertilisation. This requires leadership to break down traditional organisational boundaries and actively facilitate multidisciplinary teams.

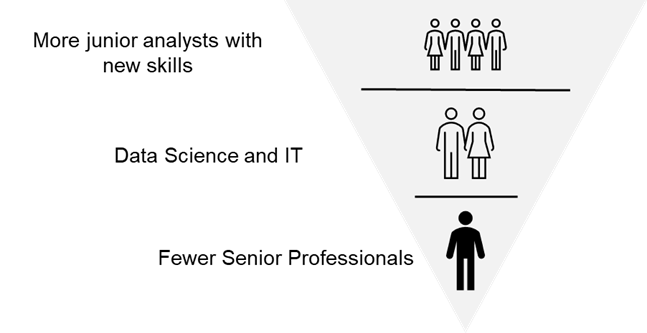

The cumulative effect of these changes is significantly improved scalability of the research department. Senior investors remain crucial as they lead projects but receive support from more IT professionals and talent with technical skills such as Python programming and AI expertise. This enables many more research projects to be executed simultaneously, dramatically increasing the department’s total capacity and efficiency. Management must lead this fundamental transformation of the traditional hierarchy and transform the organisation from a classical pyramid to a technology-driven, scalable structure. This means a shift towards more young analysts with data science understanding and, in time, reduced dependence on expensive senior investors without undermining their strategic role. This fundamental transformation of the traditional hierarchy is illustrated in Figure 1. The change in personnel composition can occur organically by adding young new talents with different skills over time, gradually strengthening existing teams without abrupt reorganisations.

Practical Example: AI Implementation in the Investment Sector

The AI integration principles described above have been concretely applied at Osmosis NL, a member of the Osmosis group of companies. UK-based Osmosis (Holdings) Limited (“OHL”) has existed for over 15 years and has focused on sustainable equity. OIM NL focuses on fixed income and has an experienced team of investors with the ambition to be industry leaders by embracing new technology. This approach has led to both technological and organisational improvements, whereby the same investment process yields much higher output.

The organisation has developed an advanced platform called ‘Sequoia’. This system helps analysts efficiently produce company analyses.

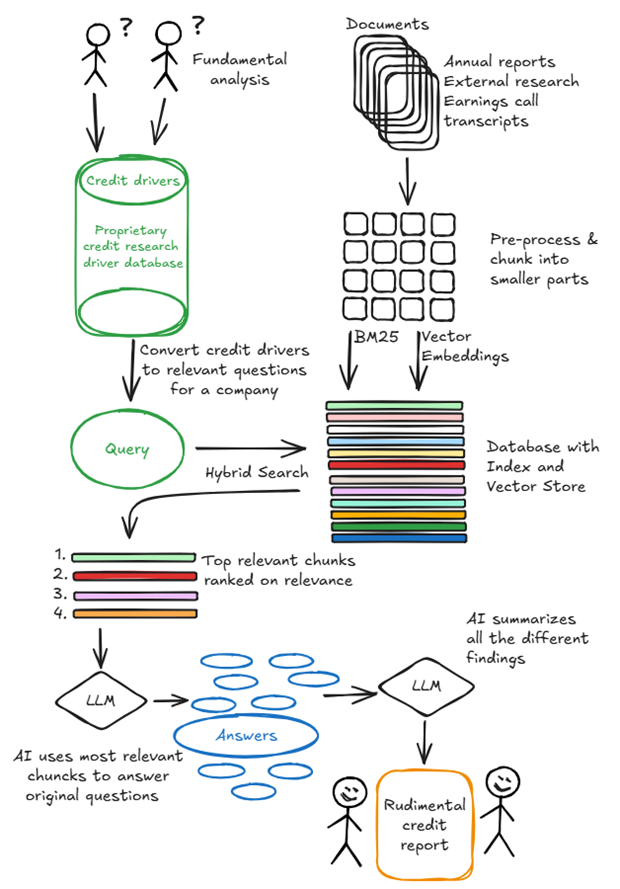

The first component of Sequoia provides a solid foundation for a credit report. When a new analysis is started, relevant documents on which an analyst bases the analysis are loaded into the system. This can be public information such as annual and quarterly reports, earnings call transcripts, offering memoranda and company presentations, but also paid research from brokers, expert networks or rating agencies. If desired, the system also has access to news and documents on the internet.

After the documents are loaded, the potentially tens of thousands of pages are thoroughly read by the system and it records what information they contain. The Sequoia platform has, besides a standard search function to quickly find needed information, the capability to answer complicated questions from analysts, such as ‘How has management adjusted expectations for EBITDA margins for the coming year following the increase in import tariffs in the US?’

For each company, the analyst has hundreds of questions ready that should provide insight into the most important drivers for the company’s credit quality. These include fixed questions that the team has asked in every company analysis for years, as well as sector and company-specific questions that analysts have developed based on their years of sector and company knowledge. Keeping these questions up to date and refining them based on the answers received remains specifically the responsibility of the investors.

This systematic questioning delivers a brief summary per driver, which serves as a building block for the final report. The analyst can trace the source for each answer for verification. This delivers enormous time and quality gains: reports are consistent and mutually comparable, whilst the analyst can immediately begin judgement formation based on the answers found. A simple example: with one question, the off-balance sheet pension deficit of an American company is sought. The documentation is read in minutes and the answer with source reference can be analysed, including any commentary from sell-side research. Figure 2 shows how this complete process from information gathering to structured analysis proceeds.

The second part of Sequoia helps with financial data extraction. Financial company reports are loaded and relevant information is automatically detected and processed. This fills the system’s as-reported database accurately and efficiently. The analyst can then make all necessary adjustments to arrive at a standardised financial model that enables comparison with other companies. This financial data and the resulting financial ratios are also directly used in judgement formation about the company’s credit quality and are automatically available in table or chart form when writing the final credit report. This automation can lead to significant savings on external data, which for organisations can amount to hundreds of thousands of euros per year.

The third element of Sequoia assists with holding the credit committee, as the team has done for the past 20 years. This is the meeting where analysts and portfolio managers share their knowledge about a company and where the analyst reaches a final judgement. The system offers supporting functions that were previously impossible, such as making clear where exactly the data in the report comes from and answering not yet fully answered questions on the spot based on the document collection or with web search. The system also helps the analyst systematically present the report to the committee and automatically records all feedback, improving process governance.

The fourth element is a dashboard with clear reports of investigated companies and credit committee decisions, where again each element is traceable to its source. This provides a complete picture of the entire investment process.

With this platform, an analyst saves around 70% of the time taken to create an investment report. This perfectly illustrates the ‘augmented intelligence’ principle: the system is explicitly designed as a supplement to—not a replacement for—the credit analyst, resulting in higher productivity and lower research costs.

The Paradox as Strategic Opportunity

In practice, OIM NL has successfully broken through the discrepancy between personal AI usage and organisation-wide implementation. This breakthrough was made possible by four crucial conditions: (1) an organisational culture that embraces technological innovation, (2) a clearly defined investment process that lends itself to systematic support, (3) multidisciplinary expertise that bridges technology and financial analysis, and (4) an approach that positions AI as an enhancement of human capabilities.

The competitive advantages achieved are significant: by utilising freed capacity for substantively better analyses and innovative service provision, investment organisations can strengthen their value proposition for clients through lower costs, faster second opinions, transparent decision processes, and insightful bias research.

This experience shows that the productivity paradox forms a strategic opportunity for organisations that dare to revise their business model—possibly the most significant change in the investment sector in decades. Scaling this approach, however, requires vision, budget, and intensive cooperation between departments. Senior management must therefore create support for a fundamental revision of processes that have remained unchanged for years. For organisations that can, and dare to, take this step, a decisive competitive advantage awaits.

Bibliography

Gavrikova, E., I. Volkova and Y. Burda, 23 July 2020, Strategic Aspects of Asset Management. Department of General and Strategic Management, National Research University Higher School of Economics, Moscow, Russia.

Humlum, A. and E. Vestergaard, 17 April 2025, Large Language Models, Small Labour Market Effects, Working Paper No. 2025-56, Becker Friedman Institute, University of Chicago, Chicago.

Ivanti, 2025, 2025 Technology at Work Report: How companies can use technology to give employees more freedom and autonomy at work, Ivanti Research, Salt Lake City. Report at www.ivanti.com/resources/research-reports/tech-at-work.

Lovich, D., J. Bedard, M. Kropp and A. Duerloo, 24 April 2025, When Companies Struggle to Adopt AI, CEOs Must Step Up, BCG Publications, Boston Consulting Group, Boston.

Rosenbush, S., 26 April 2025, Companies are struggling to drive a return on AI — it doesn’t have to be that way, Wall Street Journal, Article at www.wsj.com/articles/companies-are-struggling-to-drive-a-return-on-ai-it-doesnt-have-to-be-that-way-f3d697aa.

Schumpeter, J. 1942, Capitalism, Socialism, and Democracy.