By Victor Verberk, CEO/CIO Osmosis NL

A brief re-Introduction; “Business as Usual”

The Osmosis NL Credit Team has experienced many credit market cycles, upturns and downturns. Central to our process, the starting point has since the early 2000s been, and will remain, a thorough credit market cycle review.

It is a global view where we assess in which phase of the market cycle we are. It forms the basis of our risk-taking, playing market themes and selecting the right credits in the portfolio. We believe an objective Credit Quarterly Outlook will help to master structural biases in the team. More importantly, it helps explain to our clients why our performance is good or not.

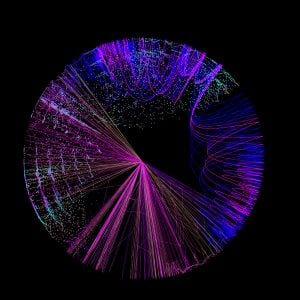

The Credit Quarterly Outlook conclusion is a graphical version of the credit market cycle. Every time we publish the Credit Quarterly Outlook, it is a new version and might not necessarily read as a next chapter in a longer storyline. It might, but Fundamentals, Valuation and Technical forces in international capital markets are strong and change quickly.

“Our Quarterly Outlook is based on four pillars: Fundamentals, Valuation, Technicals, and Transition.“

Elements such as carbon pricing or policy developments will impact risk-taking and valuations. Therefore, we will comment on the Transition positioning, which also drives alpha generation. Changing sustainable investment risk premia drives our Transition Beta up or down. A higher Transition Beta means we capture more companies that are showing progress towards a sustainable economy, and vice versa.

Credit Quarterly Outlook:

Source: Osmosis IM NL

Yield Era

Fundamentals

Economics

The world is in shock because of the unconventional policies of the Trump administration. The basis for his unorthodox policies is the imbalances that exist in global trade and finance. At its core, the Trump administration is not per se wrong! Execution is a totally different discussion…

These imbalances cannot be denied and have been built up over the past decades, as noted in our past quarterlies. Globalization has caused massive outsourcing from the West to the East. Supply chains have been optimized but remain vulnerable, as we saw during the Covid period. It has become so imbalanced that one can state that the US exports Treasuries while China exports iPhones.

Being the reserve currency, structural inelastic demand keeps the US dollar expensive versus other currencies. Global trade barriers, currency manipulation and massive outsourcing have added to the decay of the manufacturing sector in the US. Trade surpluses in the East are recycled into Treasury holdings to keep their currencies in check. The net investment position of the US is being depleted. The counterargument is that the US has been able to grow more quickly being the reserve currency, albeit on a leveraged basis. However, the benefits of this growth have been uneven, with many feeling left out.

President Trump is trying to repair these imbalances and force his allies to take care of their own military spending and safety. He uses tariffs as his tool. Many argue that this will lead to lasting inflation. However, this does not necessarily need to be the case. It all depends on the import and export mix, currency adjustments of the tariffed nations and second-round effects. Using tariffs and defense as negotiation tools is another matter entirely. That will unfold in the years to come.

US current account deficit growing ever larger to finance a growing global economy:

Source: Hudson Bay Capital, Bureau of Economic Analysis (November 2024)

Companies cannot adapt that quickly. Supply chains are under pressure, potentially leading to less investment and lower growth in the short term. This also leads to volatility in markets as uncertainty soars. Fear of lower growth, and potentially foreigners moving away from US treasuries, will lead to higher risk premia, as evidenced by the weaker dollar and higher US rates. This is not over yet. In fact, it could be the beginning of more global populistic policy-setting, which we have already seen emerging in Europe as well.

The deflationary Debt Super Cycle is dead. A new era has begun in which Credit Reckoning returns. High debt levels and sovereign budget deficits will make this a Yield Era. If one adds the demographic seismic shift that is in full force and the massive bill for the Transition to a more sustainable economy, one can imagine that yields will become more volatile and that both sovereign and corporate credit analysis will matter again.

The geopolitical landscape in Europe has shifted significantly, with a heightened focus on defense and security. The ongoing conflict in Ukraine and rising tensions with Russia have led European countries to reevaluate their defense strategies and rearmament policies. It is a massive fiscal stimulus to stay for some time.

Debt policies continue to be a contentious issue within Europe, particularly regarding the rules governing fiscal discipline and debt sustainability. Many member states advocate for reforms to allow greater flexibility in responding to economic shocks and for the use of “Blue Bonds” to finance defense spending. Germany has dropped its famous “Schuldenbremse” to allow for more fiscal spending. If Europe succeeds in reaching an agreement, it could be looking at massive fiscal investments that may boost economic growth.

Corporates

Corporate health is in decent shape at the moment. Because of this, market consensus earlier in the year was for continued strength of credit markets.

With President Trump imposing or increasing tariffs, many sectors and companies will need to adjust. For decades, the trend has been producing goods cheaply in the East and importing them to the West. Apple has been a company that has nearly perfected this model, with an estimated 90% of its production in Asia. Sectors such as retail or automotive have been sourcing cheap parts or goods from emerging markets.

These companies will need to adjust, and this will take time. Bringing production back onshore takes time and sourcing labor will be difficult due to a seismic ageing-shift in global labor markets.

“Credit selection will be important, and truly understanding corporate risk in a global macro context will be key.“

Many companies may face downgrades during this process, as leverage increases during the adjustment period. High-yield companies may not survive the adjustment, as we have already seen in the recent pickup in bankruptcies in the retail sector.

Valuations

Credit markets have moved significantly wider in the past weeks after a period of resilience compared to equities and commodities. The recent spread lows across markets (EUR and USD) touched the 2021 trough QE levels for both IG and HY, which is quite remarkable. The post-tariff spread widening raises questions about valuations and what to do next.

At first glance, US IG and HY appear to offer better value than EUR IG and HY. Not surprising at all given that closing trade imbalances imply capital outflows from the US to the rest of the world, with EUR markets being prime beneficiaries (a reversal of US exceptionalism). In the IG space, looking at current spreads, we can clearly see the US at 101bps offering value, as its trades close to its 5-year average. EUR IG, although a bit wider at 109bps, is still trading below its 5-year average.

“Yield-Era has started! US Treasury yields and IG spreads must reflect additional risk premia as uncertainty is increased.”

In the high-yield space, we see similar relative valuations with US HY appearing cheap compared to EUR HY. US HY widened at the peak by 150bps and currently trades around 400bps, just under its 5-year average, while EUR HY trades tighterfor a better credit quality. It also seems clear that HY has widened more compared to IG both in EUR and USD initially. That too is recovering already.

Curve-wise, the long-end in USD remains expensive and continues to trade very technically, with demand remaining strong. Spreads in the US, for example, remain quite tight compared to their 5-year. Interestingly, shorter-maturity bonds widened noticeably and are starting to look compelling.

US IG, from an all-in yield perspective, looks quite compelling. The Trump administration’s policies on reversing global trade, including their implementation, imply additional risk premia to be priced into US Treasury yields and credit spreads. Indeed, all-in yields have risen quite substantially over the past six months, making this an attractive proposition. All-in yields in EUR IG look perhaps less compelling, but returns still appear interesting, as Bund yields have more room to fall given ECB rate cuts (the Fed has much less room in the near term). This is something to think about as we are now in a Yield Era world…spreads and yield are both on the move now.

Nonetheless, we would stress that spreads are currently pricing in uncertainty, but not a recession, and we would favor a beta-neutral position.

Technicals

Both the US Fed and the European Central Bank are set to do more rather than less over the coming months. The impact of tariffs was the discounting of a recession and more rate cuts, typically deemed a good rationale to buy bonds. It still is, and could continue to be in months to come. But for now, interest rates have moved the other way, with yields shooting higher — not what would typically be expected with the buildup of a material recession risk. Treasuries have fallen into the narrative of “Sell America”, as investors reassess the USD’s reserve currency status and its risk-free characteristics, while German Bunds yields actually decreased slightly because of this.

It is likely that the recessionary outcome of the tariff policy will lead the ECB and the Fed to deliver more cuts this year than are currently priced in by markets. The ECB will deliver these cuts in the short term, while the Fed’s cuts will likely be more centered in the second half of this year.

Transition

In recent weeks, there has been a massive rotation among value, growth, and quality stocks. It shows that markets still have to settle and adjust to the new normal in this Yield Era. The same is true for companies that are more resource-efficient and better prepared for the future. Trump’s policies have a short-term impact, but we believe not a lasting one.

“Transition Beta matters for generating alpha — it will move up and down as sustainable investment risk premia change over time.”

The market for sustainable products keeps growing, and policy interventions have done their work. It may be a two-step-forward, one-step-back situation, but the inevitable is clear; corporates will need to embrace pricing negative externalities in cost structures. If a recession occurs, which is still not certain, carbon prices might drop further. We are preparing by doing research for transitioning fossil fuel companies to capture a short-term opportunity.

Credit Quarterly Outlook: Our new graphic

Source: Osmosis IM NL

Disclaimer

This document reflects the personal views of the credit team of Osmosis Investment Management NL B.V. (“OIMNL”) on financial markets and their underlying drivers as of the date of publication. OIMNL holds a license from the Dutch Authority for the Financial Markets (AFM) as an alternative investment fund manager (AIFM) and as a provider of discretionary portfolio management services for professional investors. This document is intended for informational purposes only and does not constitute investment advice, an investment recommendation, or an offer to buy or sell any financial instrument. Readers should not rely on the information herein when making an investment decision. Past performance is not a reliable indicator of future results. The views expressed may change without notice. OIMNL accepts no liability for any loss arising directly or indirectly from the use of this document.