By Robbie Parker, Investment Director, Osmosis Investment Management

Fearful of how central bankers might respond, investors have become fixated by the outlook for inflation. Gyrations in projected inflation have been matched by swings in the relative performance in ESG stocks. But ESG minded investors shouldn’t despair. Even if upward pressure on prices persists, sustainability can still be a winning theme.

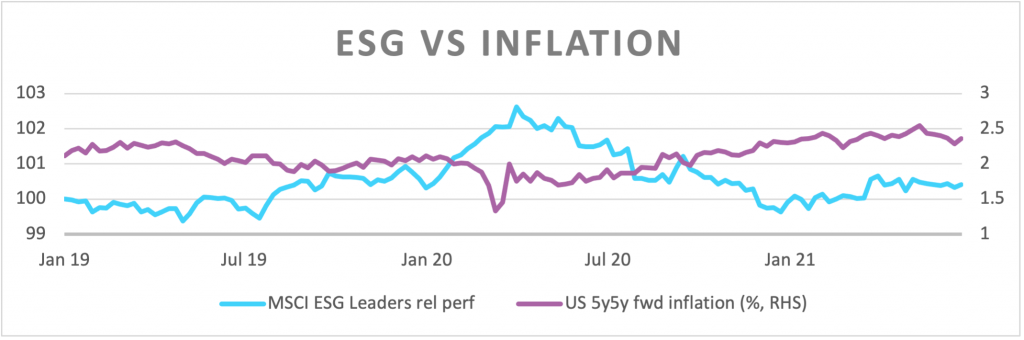

Market-based measures[1] were broadly stable in 2019 before plunging in the middle of the Covid correction only to rebound strongly as Governments reached for their chequebooks. At the same time, prominent ESG equity baskets delivered an almost perfect mirror image in relative performance (see chart); the quality bias of many ESG names was favoured when the end of the World looked nigh, only to be discarded when the recovery was underway.

“The quality bias of many ESG names was favoured when the end of the World looked nigh, only to be discarded when the recovery was underway.”

Many investors have stumbled upon a climate-friendly portfolio. By joining established momentum trades such as overweighting tech and avoiding the unloved and ‘dirty’ energy sector investors have found a lower carbon footprint can come as a windfall benefit. The building focus on reflation and cyclical recovery has seen the price of oil stocks soar since last Autumn, while tech stocks have, in line with many so-called growth stocks, had to contend with rising discount rates (bond yields). Investors have found the wild rotation of recent quarters challenging and ‘lazy’ sustainable investors will have found the going especially tough in 2021. Those who have pursued a more considered approach to creating and sustaining a climate-friendly portfolio should have fared much better.

“All investors have found the wild rotation of recent quarters challenging and ‘lazy’ sustainable investors will have found the going especially tough in 2021.”

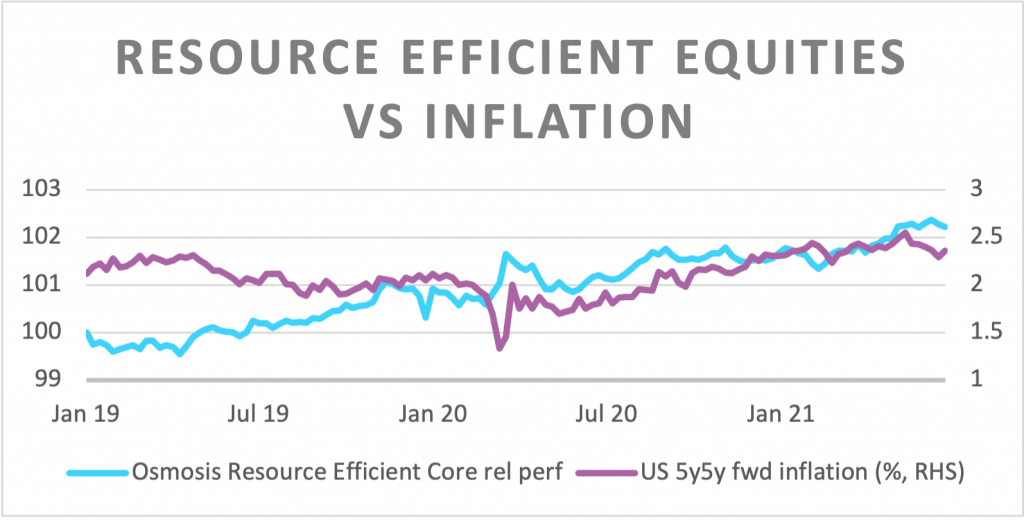

Intuitively, companies that use the planet’s scarce resources most efficiently should be able to deliver superior investment returns. While resource efficiency (‘RE’) has proven to be a reliable, uncorrelated signal of excess return over many years[1], the benefit accrues gradually to shareholders and, in the short term, is often swamped by sharp sector or factor rotations; the pro-Value rotation of last Winter being a prime example. If we isolate the sector effect, then the excess return generated by an RE-focused equity strategy has shown itself to be largely immune to the ebb and flow of inflation expectations (see graph)[2]. We see no reason why this should stop.

Crucially, we find that the largest alpha opportunities often lie in the most resource-intensive sectors, where the relative differential between “sustainable” and “dirty” companies is greatest. While low commodity prices last year, and the monetary largesse of central banks, saw even wasteful companies perform well, resource-intensive companies have remained consistently less profitable and more highly geared than their efficient peers.[1]

“Crucially, we find that the largest alpha opportunities often lie in the most resource-intensive sectors, where the relative differential between “sustainable” and “dirty” companies is greatest.”

As borrowing costs have fallen to record lows, most companies have taken on extra debt. We find no evidence, however, to suggest that extra borrowing by inefficient companies has been used to clean up their act; they remain inefficient users of scarce resources. We also find that during Covid, sector relative R&D expenditure dropped for intensive businesses whereas the opposite was true for efficient companies. Those companies that might plan now to borrow to become more efficient will likely find debt more expensive and harder to access. Further capital may have to be financed using equity, diluting current shareholders’ returns.

“We find no evidence, however, to suggest that extra borrowing by inefficient companies has been used to clean up their act; they remain inefficient users of scarce resources.”

A sector-neutral approach has been able to consistently harvest a performance differential. The policy regime shift of 2020/21 – when fiscal and monetary policy together went ‘all in’, should ensure that inflation risks, sentiment gyrations and sharp sector rotations persist; the easy gains of the past year are ended. When profitability, rather than liquidity, considerations return to shape investor behaviour and when bond yields rise from their current ‘emergency’ levels, a properly constructed Resource Efficient strategy should continue to gather alpha from efficient users of resources.

Important Information

This document was prepared and issued by Osmosis Investment Research Solutions Limited (“OIRS”). OIRS is an affiliate of Osmosis Investment Management US LLC (regulated in the US by the SEC) and Osmosis Investment Management UK Limited (regulated in the UK by the FCA). OIRS and these affiliated companies are wholly owned by Osmosis (Holdings) Limited (“Osmosis”), a UK based financial services group. Osmosis has been operating its Model of Resource Efficiency since 2011.

The investment examples set forth in this article should not be considered a recommendation to buy or sell any specific securities. There can be no assurance that such investments will remain in the strategy or have ever been held in the strategy. The case studies have been selected to be included in this presentation based upon an objective non-performance basis because we believe these are indicative of our strategy and investment process. Nothing herein shall be deemed to limit the investment strategies or investment opportunities to be pursued by Osmosis. Past performance may not be indicative of future results.

The MSCI ESG Leaders Indexes target companies that have the highest environmental, social and governance (ESG) rated performance in each sector of the parent index.

The 5-Year, 5-Year Forward Inflation Expectation Rate is a measure of expected inflation (on average) over the five-year period that begins five years from today.

Any views expressed are those of Osmosis only and should not be construed as investment advice or in any way recommending a specific security.

Osmosis Investment Research Solutions Limited (CRN 09935396)

Registered Office: 36-38 Botolph Lane, London EC3R 8DE

[1] The Osmosis Model of Resource Efficiency since 2006, and CAP IQ

[1] Osmosis Model of Resource Efficiency, Independent Cardiff University study on Resource Efficiency and Firm Value, Woon Sau Leung, Matthew Barwick-Barrett & Kevin Evans, 2014

[2] Based on Osmosis Resource Efficient Core Equity Fund

[1] https://www.usinflationcalculator.com/inflation/current-inflation-rates/